A couple months ago I read an investment write-up on a large-cap stock that is one of the most widely followed and largest companies in the S&P 500. There was a comment that basically asked the following question: “What is your edge with this stock?”

The implication of this question is that there isn’t any edge to be had with large, well-followed stocks, but there is an edge to be gained with small, underfollowed stocks.

This is a commonly held view among value investors: you need to seek out stocks that are underfollowed, in hopes of gaining bits of information that the market is not currently pricing into the stock. This is a well-intended strategy, but I think the presumption that there is a lot of informational advantage to be had in small caps is vastly overstated. This doesn’t mean I believe the market is efficient, I just think that attempting to gain an informational advantage is not the most effective way of finding value, given the wide availability of easily obtainable information in today’s market.

I did a talk at the MicroCap Conference in Philadelphia recently where I addressed three main advantages that can be had in markets:

- Informational Advantage

- Analytical Advantage

- Time-horizon Advantage

Most investors only focus on the first advantage—and this is the advantage that is most competitive.

Finding information that others don’t have is the primary reason why many investors prefer small-caps over large-caps. They think they’ll uncover something that the market currently doesn’t recognize. In the early 1950’s, Warren Buffett was turning the pages of Moody’s and found Western Insurance. This stock was a profitable, well-managed insurance company with a clean balance sheet. The stock was trading between $15 and $20 that year, and had $16 per share of earnings. In other words, it had a P/E of 1. This was not a soggy cigar butt with a bad balance sheet, it was a profitable business with real earning power and had a stable future as a going-concern.

It probably took Buffett less than 60 seconds to realize this was a good deal. And this was an example (albeit an extreme example) of information arbitrage. He found information that the market at large didn’t have. It was simply because Buffett was willing to turn the pages of Moody’s. He was doing work that others weren’t doing. Some of the stocks he found were almost certain winners. I think a lot of the low-hanging fruit has since been arbitraged away because the breadth of information and the ease with which we can access it has leveled the playing field. Everyone is out looking for bargains now.

That said, I am completely in favor of working very hard to locate undervalued ideas. And I’m completely in favor of looking at small caps for investment ideas. But unlike so many other investors, I’m just as willing to look at widely-followed large caps for ideas, and I think widely-followed large caps can become very mispriced at times.

I also think that many investors think they have found information in small-caps that others don’t have. One of the advantages of writing a blog is I hear from a lot of readers, and in the past when I have mentioned small cap stocks, I’m amazed at how many people have already researched the company I’m looking at, and have found the same information I found. There might be 100 analysts on Wall Street following Apple, but there are probably 500 or more small investors following every small-cap stock, which as a percentage of the market cap and trading volume probably equals or exceeds the coverage of the average large cap.

In other words, I’m skeptical when someone claims to have found information that the market doesn’t already have.

Again, I don’t want to imply that it’s not worth looking at small caps. I just think the gap between small-caps and large-caps in terms of publicly available information is much smaller than many realize.

Informational-Focus Goes Hand-in-hand With Short-Term Focus

Also, investors that do focus on trying to gain an information edge are typically focused on short-term information. There was recently an article in the paper that mentioned how various hedge funds are now paying for satellite imagery of farms in order to predict crop yields in the upcoming harvest. These funds are also using satellites to help them analyze traffic patterns at retailers like Walmart by counting cars in the parking lot and plotting the change in cars over a period of time.

This type of information might be useful in predicting whether or not a company will “beat expectations” in the next quarter, but it isn’t all that much of an advantage in determining the long-term value of the enterprise or its longer-term competitive position (we’ll get the same data that the satellite images provide, we’ll just get it later).

So much focus is on the short-term, and so much focus is on trying to uncover information before the market. This creates an advantage for investors who choose to focus on a different potential advantage, and that is namely time-horizon advantage.

So my answer to “what is your edge” with XYZ large cap stock is not some hidden piece of information, but it’s simply my willingness to view the business through a different lens than the majority of investors. And I think this is a real edge. I think it’s also a sustainable edge, and one that is likely to increase as investment timeframes continue to get shorter and shorter (the average investor held a stock for 14 years in 1965, and by the end of the 1990’s, this was down to 30 months. It is now likely under a year).

So I think this hyper-focus on generating short-term results, analyzing quarterly data, and emphasizing “catalysts” all help to increase the edge for those who are willing to buy good companies with no clear reason for why the value exists or when the market will correct the value.

Large Caps Get Mispriced

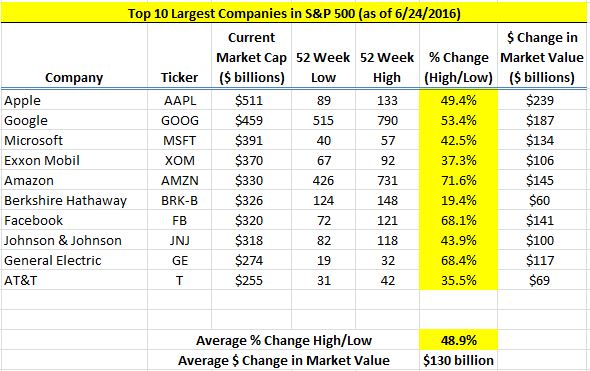

I’ve mentioned this before, but this is a snapshot of the top 10 largest stocks in the market just before the Brexit scare back in June:

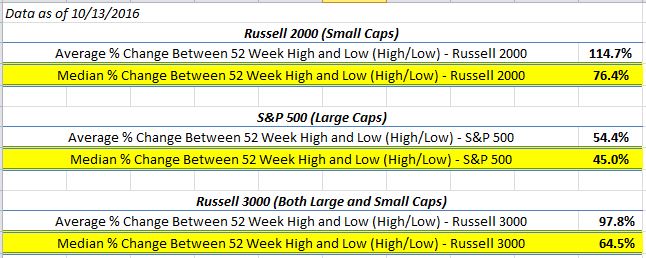

Here is a more comprehensive look at the fluctuations across a broad swath of stocks in the market. I did this analysis in October, and the changes represent the average and median gaps between the 52-week high and the 52-week low prices for stocks in the various indexes:

A Couple Examples of Mispriced Large-Caps

Bank of America is an example of how significant the gaps between price and value can be even when it comes to large cap stocks. BAC ended 2015 around $17. It traded for around $11 just over a month later in early February 2016. It now trades around $22.

In other words, the value that the stock market placed on Bank of America dropped by about $60 billion in just 6 weeks at the beginning of the year. Even more incredibly, the market now values this same company around $110 billion more than it did just 10 months ago. This roller coaster ride in market capitalization is much more pronounced than the change in intrinsic value (the value a private buyer would have paid for BAC at any given point during 2016).

How does a company as widely followed as BAC experience such a change in valuation?

Investors sold it off earlier this year because of fears about a negative impact to earnings that low oil prices would have on the bank’s energy portfolio, as well as fears related to an overall economic slowdown and a possible recession. These were factors that would have quite possibly impacted the near-term earnings outlook at Bank of America, but would be very unlikely to impact the long-term earning power of the franchise.

Those willing to look out 3-5 years and possibly deal with negative short-term results were able to buy stock in a profitable bank with a good balance sheet at really cheap prices.

Some quick, back-of-the-envelope math on the company earlier this year when the stock traded around $12 per share:

- The bank has $190 billion of tangible equity

- The company was doing 10% returns on that equity, which I thought was a reasonable proxy for normal earning power

- This equals around $19 billion in profits

- BAC has around 11 billion shares outstanding

- This is $1.70 in per-share profits

- So the stock traded around 7 times my estimate of earning power at a $12 stock price

BAC’s book value is growing at around 6-8% annually, which means the bank will have somewhere around $20 of tangible book value in 3 years. At a modest return on tangible equity of 10% (which is what the company was already doing at all-time low profit margins), the company will have around $2 of earning power in 3 years. I think this would probably be worth 10-12 times earnings or so, meaning the stock would be worth somewhere between $20 and $24 in three years, and you could buy as much as you wanted for $12.

This example is not to showcase an investment, but to demonstrate an example of a large-cap stock whose price fluctuates much, much more than its intrinsic value does. Long-term oriented investors who were willing to buy into an uncertain short-term outlook could have purchased stock in a well-capitalized stable bank at really cheap prices relative to normal earning power.

And this was simply because the buyer of the stock could take a different time horizon than the seller, who was selling shares simply because they thought the news would be bad for a few quarters (and by extension that the stock price would perform poorly in the short-term).

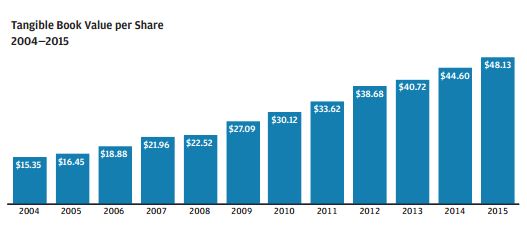

A similar story could be told at JP Morgan, which has a similarly volatile stock price, but a much more stable intrinsic value, as illustrated by the consistency and stability of the firm’s tangible book value growth over the past decade:

Note that the stock price behavior of JPM and BAC in the latter half of 2016 is completely beside the point. Both stocks just as easily could have gone lower this year if those recessionary fears became reality. But the long-term franchise value of the companies wouldn’t have changed much, regardless of what the stock market or the economy did in 2016. Both banks have sticky, low-cost deposit franchises, well-capitalized balance sheets, improving cost structures, and durable earning power despite interest rates and profit margins at all-time lows. The banks produce relatively unexciting (but stable) ROE and very modest growth potential, but the stocks at times offer significant value relative to the price paid.

The banks highlighted are just two examples of mispriced stocks this year, but there are countless examples of widely followed large cap stocks that become undervalued from time to time. I think they often get mispriced because there is a general perception that the next year or so is going to be very difficult for the company, and there isn’t any real near-term catalyst that will drive the stock price higher. This creates an advantage for those who are willing to deal with short-term underperformance.

What often happens is the short-term underperformance doesn’t even occur. Sometimes the market “advances” gains—the stock appreciates an amount in 6 months that you thought would have taken 3 years.

But regardless of how quickly the stock appreciates to fair value, I think there is a real advantage for those who are willing to buy good companies when general market conditions or company specific conditions are pessimistic (and without any clear-cut timeframe for when that pessimism will subside).

I think this advantage is part of the market structure, and unlike information advantage (which has decreased over time), I think time arbitrage’s advantage has increased. In fact, the advantage of time arbitrage has increased for the very reasons why informational advantages have decreased: technology, the ease of gathering information, the short-term focus of market participants).

In summary, I think the “edge” is less about knowing more than everyone else about a specific stock, and more about the mindset, the discipline, and the time horizon that you maintain as an investor. Thinking long-term is a commonly talked-about potential advantage, but one that is much less often acted upon. If you are a professional investor that is set up to capitalize on this, or an individual investor who has the right mindset, you can give yourself a significant edge in the stock market.

Disclosure: John Huber and Saber Capital Management clients own shares of BAC and JPM.

Links:

_____________________________________________________________________________

John Huber is the portfolio manager of Saber Capital Management, dressme.co.nz/ball-dresses.html”>LLC, an investment firm that manages separate accounts for clients. Saber employs a value investing strategy with a primary goal of patiently compounding capital for the long-term.

John also writes about investing at the blog Base Hit Investing, and can be reached at [email protected].