Charlie Munger once said that he compares every possible investment to Wells Fargo… Why buy company X if it’s not as good/cheap as WFC? For weeks I’ve been slowly and steadily working my way through hundreds of small community bank stock filings looking for bargains. A good friend of mine lately has been the trusty old FDIC website where you can find current/historical financials on banks to your heart’s content…

But after a few more hours of sifting through Call Reports on tiny banks last night, I had a thought about Wells Fargo…

I have a whole file on WFC, which I think is probably the best bank in the country. Yes, my opinion mirrors Buffett’s, but I believe I would have reached the same conclusion regardless of the Master’s opinion after studying the bank for a long time and really spending time thinking about the importance of things like earning power, return on tangible assets, efficiency (cost structure) and scale among other things that Buffett talks about in his letters.

Note that I said I think it’s the best bank, but not necessarily the best investment (although you could certainly do worse than just owning WFC). But after sifting through hundreds of community banks over the past few months, I experienced somewhat of a serendipitous “light bulb moment” last night… maybe this is obvious to some, but it wasn’t to me until last night…

WFC Better Value?

Wells Fargo is likely to be vastly superior as an investment to the large majority of these smaller community banks, many of which trade at large discounts to tangible equity.

The reasons for my conclusion would have to be the subject of a series of posts, and in the near future I may begin writing some more ideas on why I like Wells Fargo and why I believe Buffett continues to buy WFC (which is interesting given the fact he’s not buying Coke, IBM, P&G or other favorite holdings).

I will likely write at least a few other posts on WFC alone because I think it’s a great business, it’s still probably undervalued, and it has made for some great historic case studies (i.e. Buffett, Greenblatt, and Berkowitz all made significant fortunes investing in WFC after the California real estate scare of the early 1990’s, a period that subsequently saw WFC stock rise 8 fold…. And more recently, Buffett made a comment where he basically said that he’d put 100% of his net worth into WFC if he could do that (which he couldn’t) when the stock traded down to $8 in early 2009…. A period that looks to be shaping up very similar to the one two decades ago, with WFC up 5 fold in the last 5 years).

But back to my original point… I started looking at community banks because even after a large run, many of them are still significantly undervalued and probably safer than they were a few years ago (loan losses are down, leverage ratios have improved, costs are under control, etc…). But last night after going through the financials of yet another mediocre cheap community bank, I pulled up my notes on Wells Fargo just to do a comparison. Although I knew most of these numbers, it’s interesting to look at them side by side next to the numbers of any given small bank stock.

WFC Key Numbers

At $41 per share, here are some of the ratios… check that, first let me briefly define (as close to laymen’s terms as I can get) a term you’ll often see these days associated with bank stocks:

- Pre-tax, pre-provision earnings, or PTPP—as it sounds, these are earnings before taxes and before accounting for the money that a bank sets aside (provisions) for future credit losses. Many analysts will refer to PTPP earnings as “core earnings” because they more closely resemble the cash earnings that a bank produces in any given year before paying tax.

- I look at PTPP, but I prefer to use simply pretax earnings after accounting for the provisions, assuming that the provisions represent a normal, or average amount (if not, you can adjust using an average of the last 10 years or so). I think it’s a slightly more conservative way to arrive at a value, but this might be getting too inside baseball…

The basic idea is to determine the price relative to normalized earning power, whether they are pretax or after tax.

WFC Valuation

So, let’s take a quick look at WFC’s valuation relative to earnings

- 10.8 times earnings

- 6.2 times pretax, pre-provision earnings (PTPP)

- 6.9 times pretax earnings

Pretty reasonable, if not downright cheap considering the quality…

WFC Profitability

And speaking of quality, let’s look at the actual earning power ratios. Here I’ll look at the normal ROA and ROE numbers, and also look at a number Buffett focused on in the early 1990’s when he first bought WFC, which is the return on tangible equity, and the pretax return on tangible equity (ROTE):

- ROA: 1.43%

- ROE: 13.0%

- Return on Tangible Equity: 18.3%

- Pretax ROTE: 27.3%

These are the numbers that really jump out at me when I look at Wells Fargo. The bank continues to produce really high quality returns on tangible equity.

“The Lowest Costs Wins”

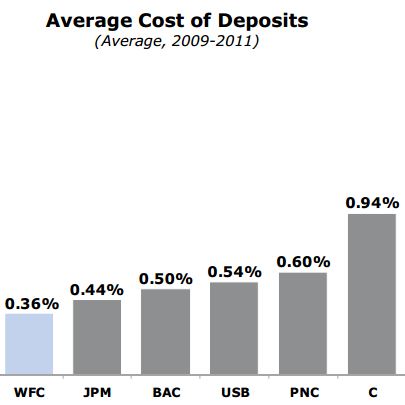

One thing that Buffett often says that I think gets overlooked is that in businesses such as banking (or commodity businesses), the company with the lowest costs wins in the end, and Wells Fargo has the lowest costs:

(source: company report and filings)

In addition to low cost deposits (the most important funding source of a bank), WFC also has a superior efficiency ratio, which basically measures the level of operating costs that a bank has (Efficiency Ratio = Non-interest expenses/revenue).

These factors are important because this is where the margin of safety principle comes into play… As interest rates and other costs move in directions that are disadvantageous to banks, Wells Fargo has a much larger cushion to withstand such impacts and still remain profitable.

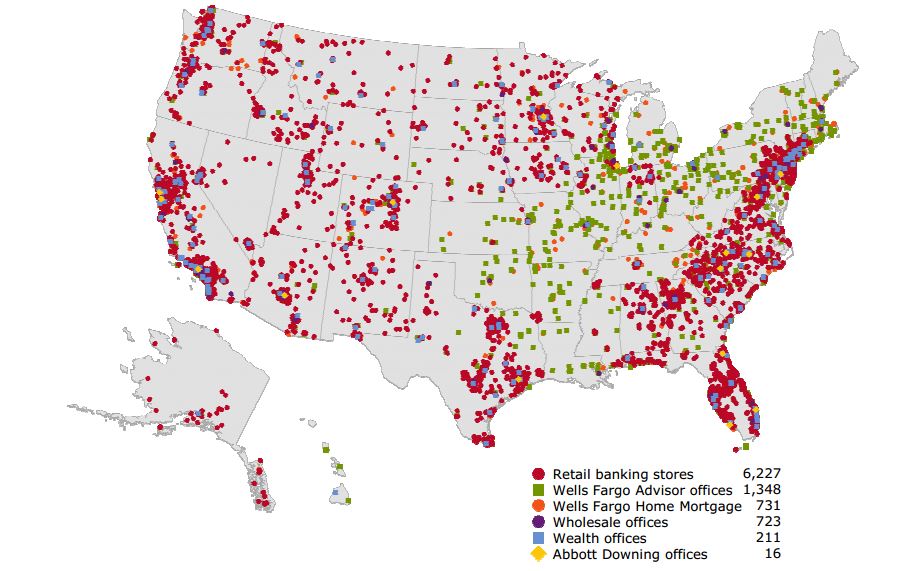

Part of this cost efficiency comes from the economies of scale–one thing that WFC has that the community banks don’t have:

It’s tough to compete with an organization that can put up a map like this…

But even if you disregard the economies of scale that WFC (and other large banks) has over small banks, the profitability ratios are far better at WFC than probably 95% or more of the community banks.

Back to Charlie Munger’s WFC Hurdle

So Wells Fargo is not expensive (some might say a P/E of 10 is cheap), it’s extremely profitable (27% pretax returns on tangible equity), and it’s got an unbelievable defense (economies of scale and low costs) that give the business a big margin of safety.

There is a lot more to discuss about WFC, but these might be some reasons why Charlie Munger always compares alternative investment ideas to Wells Fargo… Why buy company X if it’s not as good/cheap as WFC?

In the end, I found myself initially getting excited about numerous community bank stocks trading at discounts to book value… usually I lose my enthusiasm when looking at the last 10 years of income statements… typically banks that trade at discounts to book earn meager returns (often less than 5% ROE) and those returns translate into mediocre long term results for shareholders (just pull up a 10-20 year price chart of any small bank that makes mid single digit ROE’s). Sometimes a cheap bank gets acquired at a premium to book value creating a nice windfall for owners, but that involves the guessing game and the hope to get bailed out at a higher price. So I stay away from banks with poor earning power in most cases. But I do like looking at small banks (and I own a few) that are cheap on an asset basis but also produce good earnings.

Same Price for Twice the Earning Power

However, after I dig into the 10-K and the FDIC call reports, I find myself asking something like this… Why would I want to buy this tiny bank that produces returns on tangible equity of around 8%, and trades at 7 times pretax earnings when I could buy WFC that produces 18% ROTE, also trades at 7 times pretax earnings?

Of course, the initial attraction is the fact that the tiny bank trades at .8 times tangible book, and WFC trades at 2.0 times tangible book… but in the end, my guess is more wealth will be created by the company that produces 18% returns than the company that only produces 8% returns, and although the better company’s assets are more expensive, you can buy both of them at the same price relative to earnings! And, the better company has a much margin of safety via their scale (see the map above), which helps protect it during tough times…

So you get a better offense (earning power) and a stronger defense (low cost and scale) and you don’t even have to pay a premium for it! They both are priced at 7 times pretax earnings (this is just an example, but one that I’ve come across many times with these same basic numbers).

Of course, another picture that shows the power of Wells Fargo is pulling up a long term chart. This chart goes back to 1990, when WFC traded around $2, and has since averaged 13.7% annually vs. 6.8% annually for the S&P (neither numbers factor in dividends):

WFC’s earning power has certainly has rewarded shareholders over time, and you didn’t have to buy at the bottom in the early 1990’s. A shareholder who bought WFC in 1980 before the double dip recession of the early 80’s would have seen 15% compounded annual returns over the next 3 decades.

One might argue (probably accurately) that the days of those long term returns are behind it, but my guess is that WFC will continue to outperform the S&P and the majority of the smaller banks. It’s also worth remember what Forbes said about Coke in 1938 after the split adjusted stock price went from $40 to $25,000 from 1919 to 1938:

“Several times every year, a weighty and serious investor looks long and with profound respect at Coca-Cola’s record, but comes regretfully to the conclusion that he is looking too late. The specters of saturation and competition rise before him.”

That initial share of KO that cost just $40 in 1919 and turned into $25,000 in 1938 proceeded to increase to roughly $14 million where it is today (or around 14% CAGR over 94 years)…

WFC vs Small Banks–One Last Football Example

It’s almost as if you could buy Peyton Manning for the same price as say Russell Wilson (second year starting QB for the Seahawks who–although certainly will be getting a raise when his contract gets renegotiated–currently earns under $1 million). Yes, Manning is clearly better, but Wilson has his whole career ahead of him, and has played incredibly well in his first two seasons. But if that’s the case, why do the Broncos pay Manning $20 million a year? Because even at age 37, he’s worth a lot more.

If you can find a Manning (Wells Fargo) priced at the same level as a Russell Wilson (good community bank), you might want to either buy the Manning or wait for the Wilson to trade at a significant discount to the Manning.

I have much more to say on banks in general, WFC, Buffett on banks, and others… but we’ll pick it up another time…