“In the end, banking is a very good business unless you do dumb things.” – Warren Buffett

Buffett has been investing in bank stocks since the 1950’s, and I think one of the things he probably likes most about banking is the predictability of deposit growth. As he says, if you don’t do dumb things—if you stick to taking in deposits and lending them out, you’ll mint money.

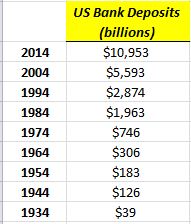

All the money center banks reported earnings a couple weeks ago. In the process of reviewing their filings, I also spent some time doing some research on the FDIC website and I found a table that the FDIC updates on industry-wide total deposits at all US commercial banks. At the end of 2014, US commercial banks held $10.9 trillion in deposits.

High and Predictable Deposit Growth

Here is the incredible statistic: US commercial bank total deposit growth has grown every single year (not a single down year) since 1948! There have only been 3 years where industry-wide deposits shrank from the year before (1937, 1946, and 1948, and these three years were all very modest declines).

So deposits across the industry have grown for 66 consecutive years.

Even more incredible is the rate of growth in deposits over the past 80 years. Since 1934, deposits held by US commercial banks have grown 7.3% per year. In the past 50 years, they’ve grown at 7.4%. In the past 25 years, they’ve grown at 6.0%. In the past 10 years, they’ve grown at 7.0%.

So incredibly, the growth rate doesn’t seem to be slowing down much. I’ve always thought of deposits as something that would grow at maybe just a very slight premium to whatever GDP does over time (2-4%). But at least over the past 80 years, they’ve basically doubled the growth rate of GDP.

I remember Buffett saying something about servings of Coca-Cola sold has risen every single year for 100 years or so. I bet he feels the same about the predictability of deposit growth.

He probably feels the same way about loan growth as well as bank earnings for that matter (which have also risen steadily and unlike airlines, the US banking industry has been profitable in 78 of the past 80 years).

And unlike Coke, since deposit gathering is a commodity type business, the lowest cost business will have the biggest advantage.

Unfortunately for the small community banks which have decreased in number by 2/3rds in the past few decades, the big regionals and the really big guys have these cost advantages. Wells Fargo is currently paying 0.08% (8 basis points) for its $1.2 trillion in deposits. WFC largely funds its asset base with these low cost deposits (the total cost of their funding sources is just 25 basis points), meaning that even in this low yielding environment, it makes a healthy return on assets. Other big money center banks also gather deposits very cheaply, but because deposits make up most of WFC’s liabilities (which also fund a more traditional higher yielding asset base—loans and securities), the bank achieves better returns on capital than the majority of its competitors.

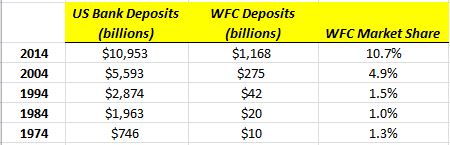

Throughout its history, WFC has always taken market share. I took a look at the 1974 WFC annual report. In 1974, WFC had deposits of $10 billion, today they have $1,202 billion. So in the last 40 years, WFC has a 12.7% deposit CAGR. They’ve grown overall deposit market share from 1.3% in 1974 to 10.9% today:

(By the way, www.wellsfargohistory.com is one of the best company investor sites: 50 years of annual reports and other info).

So WFC has grown deposit market share, and grown share almost every year—especially in the past 3 decades. Given certain banking regulations and WFC’s size, you could argue that they’ll stop taking share, but as long as they just maintain their share (a pretty good bet given their track record), it seems pretty predictable to rely on steady mid-single digit deposit growth year in and year out. These deposits are the raw material that is used to create loans, which also have grown steadily over the past 80 years (loans have grown at a CAGR of 8.1% since 1934).

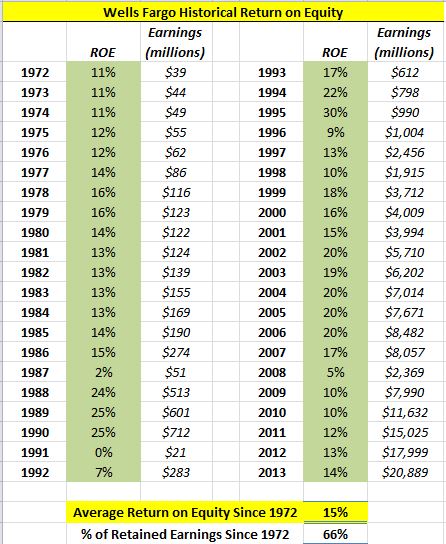

If you look at WFC’s ROE, it’s been a consistently profitable bank throughout history:

For the past few decades, the bank has consistently produced better than 1.5% ROA. At 10x leverage, this is about 15% ROE. Recently in this zero interest rate world the ROA has slipped to around 1.3%, so maybe you would say 13% is a better estimate of what shareholders can expect the bank to earn on their capital, but I doubt that a) interest rates remain this low forever and b) ROA doesn’t begin rising once ZIRP comes to an end.

With the deposit numbers and the low-cost moat of WFC, it’s hard to see value per share not compounding at 8-10% (at least) over time through a combination on asset and book value growth, steady returns on assets, and capital returns via buybacks and dividends.

The Investment Case for the Warrants

I have owned Wells Fargo through the warrants in the past, and bought them back during the August swoon when Wells traded down to 50 and the warrants got down to 17. What are the warrants? They are unique securities that were created by the government as part of the TARP Capital Purchase Program, where the government injected $205 billion of capital into the US banking system in exchange for debt securities, preferred stock, and in some cases, warrants to buy common stock.

The warrants are similar to deep in-the-money options, only with a very long time period before expiration as well as a few other small benefits. Originally held by the Treasury, these warrants were eventually sold at auction to the public and now trade on the NYSE. The warrants give the holder the right to buy a share of common stock between now and late 2018 for around $34 per share. The warrants have an anti-dilution clause which means dividends will reduce this strike price to around $33 by expiration.

I bought a decent amount when they traded down in August, but wish now that I would have really loaded up. I was somewhat reluctant to really back up the truck as I have sizable positions in a couple other banks. But I should have swung harder, and actually am considering buying more. With the warrant price around 21, the strike price around 34, and the current stock price around 55, it’s nearly free leverage so it allows me to keep a sizable cash position in the portfolio for other investments.

Buying the warrant is like putting a 30% “downpayment” (cost of warrant) on a share of WFC, but without having to pay any interest while I own the warrant and I’m not even required to pay back the “loan” (the value of the rest of the stock) if I decide to sell. I think the warrants of the big banks are some of the best investment opportunities in this market because of the quality of the underlying businesses, the value of the underlying common stocks, and the long-dated nature of the security itself.

Valuation

WFC had a book value of $33.69 as the end of the quarter, up 7% from the previous year. At low-teen returns on equity and factoring in the dividend payout, I think it’s a safe bet that WFC compounds book at 7-8% annually. This puts book value around $42 per share in 3 years when we will have to convert our warrants into common stock (or sell them). If Wells can do 13% ROE (historically low, but what it has been doing this year), the bank will earn around $5.50 per share. At 12-14 times earnings, this equates to a price of around 32 to 44 for the warrants, which are currently priced around 21.

I think that’s a pretty good return over the next 3 years—especially given that I think the downside chance of losing any money is extremely remote. Banks are much safer, much better capitalized, more streamlined, and their stocks are much more cheaply valued than the pre-crisis days. Short of an environment that leads to either severe financial stress and/or single digit P/E ratios (which is possible but not probable), it is unlikely these stocks will be lower in 3 years than they are now—in which case the warrants don’t lose. If ROE begins to rise a bit when rates rise, the returns for the warrants start to get extreme, but that doesn’t need to happen for the investment to work out very well.

I think Wells is the best bank among the big money center or regional banks—it’s not the cheapest and I think some other banks might offer more interesting returns, but I think it’s the highest quality bank of the group. I find these warrants to be attractively priced.

Disclosure: John Huber owns warrants to buy Wells Fargo common stock for his own account and accounts he manages for clients. This is not a recommendation. Please conduct your own research.