This is just a quick post on some interesting articles I read over the weekend as I caught up on some newspaper reading.

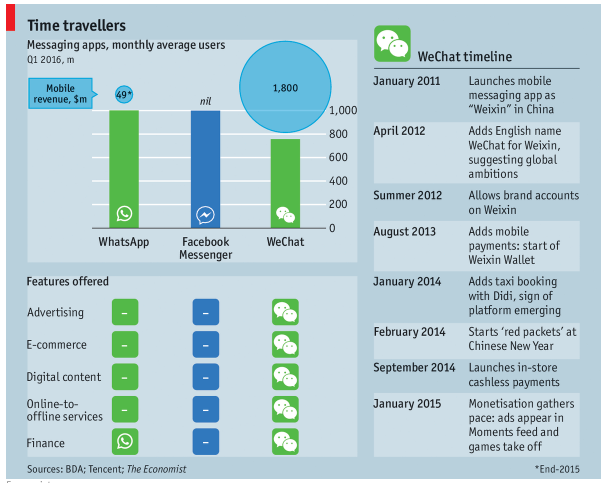

There were a couple recent pieces (one in the Economist and one in the NY Times) on WeChat, the Chinese messaging app that now boasts over 700 million users. WeChat is also generating a significant amount of revenue (unlike Facebook’s WhatsApp and Messenger apps that haven’t monetized their networks yet). WeChat is also estimated to be very profitable for its owner, Tencent Holdings, an online gaming and social media giant in China.

Here are a few notes as I read the two articles:

What is WeChat?

From the Economist piece:

“Like most professionals on the mainland, her mother uses WeChat rather than e-mail to conduct much of her business. The app offers everything from free video calls and instant group chats to news updates and easy sharing of large multimedia files…

“Yu Hui’s mother also uses her smartphone camera to scan the WeChat QR (quick response) codes of people she meets far more often these days than she exchanges business cards. Yu Hui’s father uses the app to shop online, to pay for goods at physical stores, settle utility bills and split dinner tabs with friends, just with a few taps. He can easily book and pay for taxis, dumpling deliveries, theatre tickets, hospital appointments and foreign holidays, all without ever leaving the WeChat universe.”

Here is a snapshot of the app compared to the two other huge messaging apps (both owned by Facebook):

Why/How was WeChat able to grow so quickly:

- SMS messaging is costly in China. This is unlike the US where large telecoms bundled text messaging services with other basic phone services to make texting affordable.

- In the US, this affordability of texting via your phone provider also meant that there wasn’t as much of a need for a separate dedicated messaging app. This is partly why messaging apps like Facebook’s Messenger or WhatsApp, while very popular in the US, aren’t completely ubiquitous like WeChat is in China. There are 700 million users despite there being “only” 600 million smartphone users in the country. Just about everyone uses WeChat in China.

- The higher cost of text messages in China led to a gap that WeChat was able to fill. Users eager to text one another quickly led to mass adoption and a foundation for WeChat to provide other offerings to its suddenly vast network of users.

- China consumers largely skipped right to smartphones—many never purchased a PC. The lack of experience using a desktop made it more natural for Chinese consumers to complete tasks on a mobile device that Americans and Europeans might still be using their PC’s for. Half of all online sales in China take place on a mobile device, versus roughly a third in the US.

- The app ecosystem didn’t grab hold as much as it did in the US and Europe. Instead of smartphone users utilizing hundreds of apps that each perform unique functions, firms in China like Baidu, Alibaba, and Tencent have developed apps that can perform many different tasks (messaging, social media, games, mobile payments, ecommerce, videos) all within the same app.

Network effect

WeChat’s exponential growth in users has created a platform that has allowed the app to branch out into mobile payments and ecommerce, among other offerings. Consumers can make purchases directly from merchants (who are increasingly attracted to the vast potential customer base), with WeChat taking a cut on every transaction. As the number of users grows, so does the value proposition for potential merchants, advertisers, and developers (who can create their own apps inside of the WeChat universe).

The Economist summarizes the network effect:

“E-commerce is another driver of the business model. The firm earns fees when customers shop at one of the more than 10m merchants (including some celebrities) that have official accounts on the app. Once users attach their bank cards to WeChat’s wallet, they typically go on shopping sprees involving far more transactions per month than, for instance, Americans make on plastic. Three years ago, very few people bought things using WeChat but now roughly a third of its users are making regular e-commerce purchases directly through the app. A virtuous circle is operating: as more merchants and brands set up official accounts, it becomes a buzzier and more appealing bazaar.”

WeChat’s First-Mover Advantage

The more fragmented app ecosystem in the West will make it harder for any one messaging app (including WeChat) to build as powerful a network effect as WeChat has done in China. Western users already use many different apps for a variety of services, and so it will be difficult for any single app to achieve the winner-take-all status that WeChat was able to grab in China. But as the article summarizes, this also creates a moat for WeChat on its home turf:

“Nor is there much chance that Facebook could make a significant dent in WeChat’s dominance in China. The Silicon Valley darling enjoys incumbency and the network effect in many of its markets. That has sabotaged WeChat’s own efforts to expand abroad… But the same rule applies if Facebook enters China, which could happen this year or next. ‘We have the huge advantage of incumbency and local knowledge,’ says an executive at Tencent. ‘Weixin (the Chinese name for WeChat) is quite simply more of a super-app than Facebook.’”

Tencent’s Potential Crown Jewel?

The app that is there “at every point of your daily contact with the world, from morning until night” is a very valuable asset for its owner Tencent Holdings.

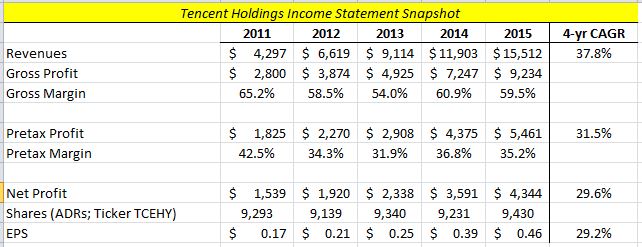

I haven’t spent any time looking at Tencent, but I did pick up the annual report this weekend and skim through it. Here are the numbers of for the past five years that I converted into USD at the current exchange rate as of today:

The company makes most of its revenues and earnings from online gaming, with advertising generating most of the rest of the revenue. WeChat’s revenue was an estimated $1.8 billion last year, which is a small piece of the pie at this point. Time will tell if the company is effective at monetizing the platform that it has built (which is needed to justify the stock’s current valuation), but it appears to be building a lot of momentum.

I had never looked at Tencent before, but I put it on a watch list to study more in depth. I’ve been wary of investing outside the US (which is my own geographical circle of competence). But investing is a game of connecting the dots, as Ted Weschler said recently, and reading articles about growing businesses like this adds a few new dots to the mix.

Here are some other pieces to help connect the dots:

- WeChat’s World (The Economist Article refenced above)

- China, Not Silicon Valley, Is Cutting Edge in Mobile Tech (The NY Times piece refenced above)

Some other articles that discuss WeChat or the business of apps in general (some are old, but I thought still provided helpful context):

- When One App Rules Them All

- Chinese Mobile Apps UI Trends (Excellend blog post that was recommended by a reader)

- A 2014 Economist piece on WeChat

- Business of Apps: WeChat Stats

- How Messaging Apps Make Money

________________________________________________________________________________

John Huber is the portfolio manager of Saber Capital Management, LLC, an investment firm that manages separate accounts for clients. Saber employs a value investing strategy with a primary goal of patiently compounding capital for the long-term.

John also writes about investing at the blog Base Hit Investing, and can be reached at [email protected].