Fastenal (FAST) reported earnings yesterday. I love reading Fastenal’s press releases. They are more like investor letters than they are press releases. I didn’t even see one “Adjusted EBITDA” reference in the entire release—which is written in layman’s terms more than corporate jargon. Management’s candidness and depth of discussion regarding the company’s operating results is a breath of fresh air.

So I thought I’d jot down a few notes and put it into a post. This is not really an analysis of the company, but more or less just a clipping of portions of the letter I thought were worth commenting on. It’s mostly a summary of the press release, but I’d definitely recommend getting in the habit of reading these once a quarter. If nothing else, it’s a respite from the typical corporate-speak that permeates most of what I find in the company filings I read.

To briefly summarize, the company has an outstanding history of growth, but that growth has been challenged lately—in small part due to Fastenal’s increasing size, but much more likely due to the significant difficulties in the heavy manufacturing and commodity-based businesses (who represent a sizable portion of Fastenal’s customer base).

Fastenal has always been able to grow throughout the business cycle, but this cyclical downturn is proving to be one of the more difficult periods that they’ve had to navigate so far.

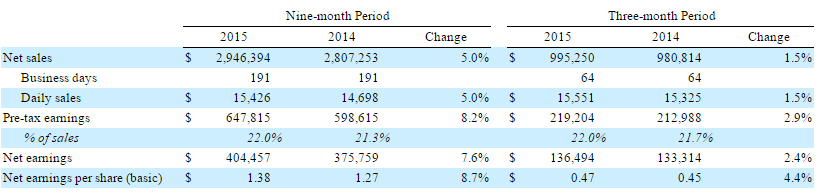

That said, to this point they are still squeaking out some growth:

They think that revenue has been hit because their customers have felt the effects of a strong dollar, and of course the slowdown in the oil and gas business.

Making Their Own Luck

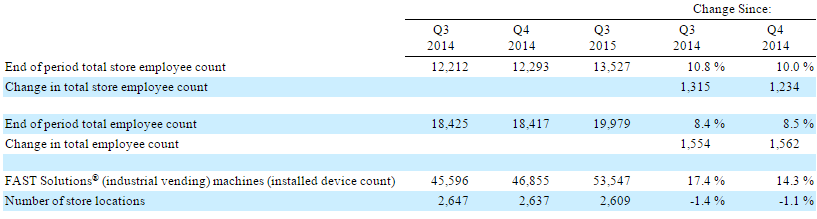

Interestingly, they have been aggressively adding employees during this downturn. Fastenal has always felt that they employees are one of the largest competitive advantages they have. A knowledgeable, well-trained sales force that understands how to effectively engage with the customer base is an advantage that often doesn’t show up directly in the numbers, but like the left tackle that is diligently and thanklessly protecting the quarterback all game, it’s an invaluable part of the team.

Fastenal has ramped up hiring:

In addition to expanding the headcount, they plan to open an additional 60-75 stores (around a 2-3% increase in store count) in the next year.

Fastenal management describes the company as two businesses:

- Fastener distributor (40% of business)

- Non-fastener distributor (60% of business)

Fastener Business

This is the business Fastenal started with 50 years ago. Fastenal is a distributor. They supply their customers with a variety of basic fasteners such as nuts, bolts, screws, washers, etc… The company sources these products from many different suppliers, and then sells to their more than 100,000 customers at a healthy markup (Fastenal’s gross margins generally are around 50%). Fastenal’s customers are usually the manufacturers at the end of the supply chain (farm manufacturers, oil producers, truckers, railroads, miners, etc…). The company also sells to non-residential construction contractors (plumbers, electricians, general contractors, etc…).

Roughly half of this business is production/construction and the other half is maintenance. The production portion of this business is very cyclical, with 75% of the customers engaged in some type of heavy manufacturing. This business is struggling right now. Fastenal mentioned that although they are steadily adding new national accounts (large customers), 44 of its largest 100 customers are reducing their spending on Fastenal products, many because they are seeing significant revenue declines in their respective businesses and thus tightening the spending belt is a necessary result. This hurts Fastenal in the near term, although the company expects this cyclical capital spending to work in their favor once the recessionary conditions in the energy and mining businesses subside.

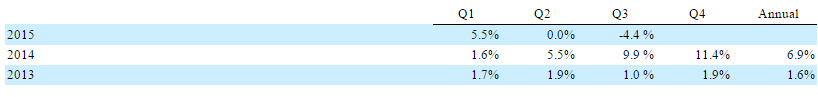

But the downturn in commodities and the heavy manufacturing sector has caused growth in Fastenal’s industrial production business to go negative:

Non-Fastener Business

Fortunately for Fastenal, the sale of fasteners is a sticky business because it’s difficult (expensive and time consuming) for customers to change their supplier relationships. This stickiness has probably even improved as Fastenal grows its vending machine business which primarily focuses on distributing non-fastener products (instead of candy bars, FAST is popping out tools, equipment, and other non-fastener products through vending machines at their customers’ own facilities):

So with a Fastenal vending machine onsite at the customer’s location (along with knowledgeable Fastenal employees providing service and product replenishment), this creates a resilient line of business for FAST. In fact, they now have around 53,000 machines onsite at their customers’ facilities—all doing an average of around $1000 per month of business (that’s a $600 million business that grew 17% in the last year).

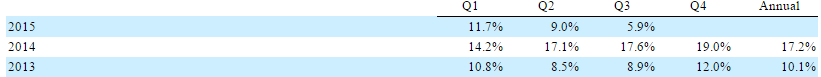

So strong results from the industrial vending business is helping the non-fastener segment of Fastenal’s business, but the overall segment has seen growth slow from 18% in the last half of 2014 to 6% growth in Q3:

So this non-fastener business is still growing, albeit at a much slower rate. And management says that they are still taking market share.

Macro Winds Impacting Fastenal’s Business

Fastenal believes growth is impacted generally by three categories:

- Execution

- Currency Fluctuations

- Economic Fluctuations

My take is Fastenal is executing very well–as best as they can in this environment. So the latter two are the culprits. Currency fluctuations only impacted Fastenal’s growth by 1.1%, so not a significant decline due to the weak Canadian dollar. However, Fastenal’s US customers represent 89% of sales, and many of those customers are impacted by the strong US dollar. So I think that Fastenal is probably impacted much more indirectly by the strong US dollar than they are directly as a result of their Canadian operations.

Economic Conditions

Sales to customers engaged in heavy manufacturing are estimated to be about 20% of overall FAST net sales. These businesses include the mining, agrictultural, and construction end markets, and all of these sectors have been hit hard by the bear market in oil and other commodity prices and a slowdown in construction and weak Chinese demand for heavy equipment.

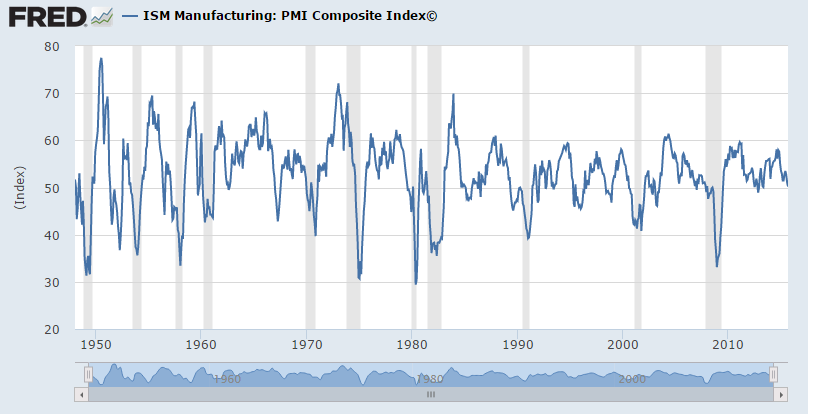

PMI Index

The Institute for Supply Management conducts monthly surveys of private sector companies to gauge the health of the manufacturing sector. The oft-cited Purchasing Managers’ Index (PMI) oscillates between 0 and 100 (spending most of its time between 40 and 60) and basically measures manufacturing expansion when readings are over 50 and contraction when the index drops below 50. The PMI can be thought of as a general barometer of the current strength or weakness in the buying power of Fastenal’s customers that do business in the heavy manufacturing sector (again, approximately 20% of Fastenal’s revenue is impacted here). The PMI has spent most of its time since the recession in the mid-high 50’s but dropped to 50.2 in September, the lowest reading in 3 years:

So who knows what economic conditions will look like in a year (I certainly don’t), but the slowdown in the manufacturing sector has, for the first time, really affected Fastenal’s top line growth.

Valuation and Some Commentary

I think FAST is an outstanding business with moderate growth potential over the long run. They operate in a large and fragmented business and their scale, employee expertise (these sales guys know their products well), the sticky nature of their customer relationships, the thriftiness that management has toward expenses, the small ticket price of most of their products, the vending machine program (getting a spot on the customer’s location is huge)—these are all attractive features to me about Fastenal’s business.

By the way, any Harvard MBA who claims that expense management and frugality is not a competitive advantage should read this: The Cheapest CEO in America. They should also pull up a long term chart of Fastenal stock price, and see how a company that sells nuts and bolts and keeps costs low somehow has been able to eat their competitor’s lunch for decades.

By keeping operating costs very low, Fastenal is able to pay their employees incrementally higher wages and thus more effectively develop and retain talented salespeople. The quality of service and depth of knowledge that the employees have eventually brings in more revenue, which grows the business and allows it to further lower operating expenses as a percentage of revenue, thus allowing for more hiring of top quality employees, which brings in more revenue, etc… Maybe an overlooked virtuous circle of sorts.

I think that the business will continue to grind out steady profits and steady growth for a while to come. I think that the business might struggle to grow in the near term given the horrendous state of affairs in certain portions of the commodity-based industries and heavy machinery businesses. But I think over time these are normal aspects of just about every business cycle and this isn’t Fastenal’s first rodeo. They are a very well-managed firm and will no doubt see this through.

What is it worth? The company produced $401 million of operating cash flow in the last 9 months. I’m not sure that the stock is a bargain at 20 times cash flow since

- the company has stated that there are still sizable capital investments needed to continue to grow its vending machine business (although those investments have been attractive so far), and

- it seems unlikely that the company will be able to achieve the sizable mid-teen rates of growth it has in years past.

Should I be wrong on the latter, the stock is probably cheap. I’m not worried about the capital investments because those seem to be producing solid returns. But I would be concerned about the future growth of the overall company. They claim to operate in a $160 billion market, which implies a long runway ahead, but the larger they grow the more bumps in the road there are (as a friend said, Fastenal used to be a meaningless portion of many of its customers’ expense budgets, but if Caterpillar or some other struggling large heavy manufacturer now sees that it’s paying $30 million to Fastenal, they may become more motivated to spend the time renegotiating that contract).

Eventually, the recessionary conditions many of its customers are facing will subside, and Fastenal will get the benefit of a cyclical upswing. And Fastenal will certainly continue to execute well and grow revenue over a long period of time. I’m just uncertain how fast that growth rate will be, and so at this valuation I’m not sure there is a big margin of safety.

That said, Fastenal has always exceeded expectations to this point (as evidenced by the fact that throughout history the stock has been too “cheap” most of the time—compounding at 23% per year since 1987):

Quite the wealth creator over time. Since the IPO in the mid-80’s, the stock has done better than BRK, MKL, WFC, WMT, AAPL, MTB and just about every other long term compounder out there.

If anyone has comments on the business, valuation, future prospects, or anything else, feel free to engage.

Thanks for reading.

_____________________________________________________________________________

John Huber is the portfolio manager of Saber Capital Management, dressme.co.nz/ball-dresses.html”>LLC, an investment firm that manages separate accounts for clients. Saber employs a value investing strategy with a primary goal of patiently compounding capital for the long-term.

John also writes about investing at the blog Base Hit Investing, and can be reached at [email protected].