I thought I’d write a post with some quick thoughts on Markel’s value. I recently had a few conversations with a friend regarding how to think about the return on equity that Markel produces relative to the investment return that you will receive as a shareholder. For example, I’ve had a couple questions from clients similar to this: “It’s great that Markel can produce 15% ROE over time, but will we receive 15% if we’re paying above book value?” The current price of Markel is somewhere around 1.3 times book, so this is a relevant question.

First off, I wrote a much more detailed post with my thoughts on Markel earlier this year, so I won’t rehash why I think Markel is a great business here. If you’re interested in what I think about Markel as a business, please check out that post.

But back to the question: If Markel produces X% ROE, will I get X% on my investment if I’m paying above book value?

To answer the question, I need to explain how I think about Markel. Although I’ve referenced Markel’s book value growth over the past few decades, I don’t really value Markel relative to book value. In fact, I don’t usually value anything relative to book value. I’m interested in earning power.

Buffett once made the following comment regarding Wells Fargo:

“You don’t make money on tangible common equity. You make money on the funds that people give you and the difference between the cost of those funds and what you lend them out on.”

Buffett was talking about banks, but the same concept applies here. Unless Markel gets liquidated, book value is not really relevant. What is relevant is how much value Markel can wring from that equity capital.

So I think about Markel like I think about most other businesses: using a price relative to earning power, not book value. And one way to think about it is this: As long as you are paying a fair price for Markel—one that is equal or below intrinsic value—and Markel can grow intrinsic value at 12-14% per year, then you should expect 12-14% shareholder returns over a long period of time.

And you could look at the P/B ratio of 1.3 to determine valuation, but what I do is compare the P/B ratio to the ROE, which essentially values the business using a price to earnings ratio rather than price to book.

Think about it this way… Markel is priced at 1.3 times book. If Markel produces 13% ROE over time, then you’re paying 10 times earnings at the current price (At the risk of stating the obvious, let’s review simple math and invert our P/B thinking with a quick example of Stock XYZ. Let’s say XYZ has:

- Book value of $100 per share

- P/B ratio of 1.3

- ROE of 13%

In this case, XYZ is priced at $130 per share (P/B of 1.3 times $100 book value), and is producing $13 per share in earnings (13% ROE on $100 book value). So the stock (at $130 per share) has a P/E ratio of 10.

So, if Markel’s ROE averages 13% over time, then at 1.3 times book (roughly the current valuation), Markel currently has a P/E ratio of just 10. If Markel produces 15% ROE over time, then you’re getting the stock at just 8.7 times earnings at the current price. Again, this is probably obvious, but I thought some explanation might be necessary since everyone always likes to talk about P/B ratios when it comes to financial companies. This makes some sense since financial companies’ earning power is somewhat tethered to the amount of capital they have, but what really matters is earning power, not book value.

So I think about the value in terms of price relative to earning power, not directly in terms of price relative to net worth on the books. Markel earns much more on its net worth than most other insurance companies, so I think price to earning power is much more relevant way of thinking about valuation.

Note: Please keep in mind that Markel is priced around 10 times earnings (normal earning power) at the current level, but these are comprehensive earnings, not GAAP earnings, as some of the earnings come from unrealized gains that don’t flow through the income statement.

A Simple Way to Think About Markel

So I’ll lay out a very simple way that I think about Markel (update numbers):

- $17.6 billion investments

- $2.3 billion debt

- $1250 investments per share

- $510 equity per share

- 5% after tax investment return = $63 per share in investment earnings

Markel over time has been a consistently profitable insurance business. I’m assuming they will make enough money to pay the relatively small interest charges on the debt along with all other expenses associated with the insurance company.

So in this example, we have a business that produces 12.3% returns on equity, and $63 per share in earnings.

So here is what we have if Markel produces the numbers above:

- $63 per share earning power

- P/E of 10.8

Instead of thinking about the return on Markel’s investment portfolio, you could also think about Markel in terms of book value compounding or return on equity. Basically, over time Markel has compounded book value at better than 15% annually, which means that their comprehensive return on equity (including unrealized gains) has been in the neighborhood of 15%.

Also, it’s worth noting what Markel said in the 2013 annual report:

“We believe that the five year change in book value is now just as important a measurement to consider when thinking about the value of your company as the book value itself.”

Basically, they don’t really view book value as a relevant proxy for intrinsic value, but they do view the growth of book value over time as a decent proxy for the growth of intrinsic value over time.

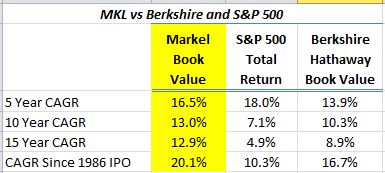

And growing book value (producing high returns on equity over time) is something that Markel has excelled at:

In other words, don’t look at the static value on the books—look at the growth of that value over a long term time period (5 years or more). This will give you a better view on how Markel is doing at growing intrinsic value.

So all of this boils down to a few questions:

- How fast is Markel compounding intrinsic value?

I would say that if they can produce 12% ROE, they’ll be able to grow intrinsic value at around 12% over time. It’s a back of the envelope way to think about it, but it’s been true over decades, and I think it will be true going forward. One can argue about what their ROE will be going forward. I predict it will be better than 12%. But for now, let’s say the insurance company just breaks even after paying interest and we get 12% ROE, and thus 12% growth in intrinsic value going forward.

The next question is naturally:

- What price do we have to pay in order to ensure that our investment returns match the intrinsic value compounding?

The answer here is quite simple: In order for our investment returns to match the 12% compounding of intrinsic value, we need to just make sure we pay a price that is at or below the current intrinsic value.

How do we determine this? My method is simple. I think about what a rational private owner would be willing to pay for a business that has compounded intrinsic value at between 15-20% annually for decades, and will likely compound intrinsic value at a rate of 12% for a period of time going forward. And while this answer could have a wide range of values, my guess is that this private buyer would be willing to pay more than 10.8 times earnings, which is where Markel is currently priced.

So to me, it’s that simple. It’s not scientific, and there are no spreadsheet models. I like to keep Ben Graham’s comment in mind that you don’t need to know the exact weight of a 350 lb man to know that he’s fat.

To me, a business that produces 12% (my guess is this is quite conservative) returns going forward and is currently available at 10 or 11 times earnings is a bargain.

My guess is someone would probably pay at least 12-15 times earnings for this type of business.

So to sum it up, Markel has historically compounded its book value at 20%. I think the growth of book value, not the current point in time value, is what’s relevant in thinking about the intrinsic value. As for the current price, Markel is priced around 1.3 times book value, but the way I think about this is simply that 1.3 times book at 12% ROE is simply 11 times earnings.

I think Markel is worth much more than 11 times earnings, and even if I’m wrong, I’m getting a business that is compounding at 12%.

Not bad. Although this would be a satisfactory result, my guess is that we’ll get:

- Slightly better than 12% returns because of profitable underwriting over time

- Higher valuation at some point in the future

I don’t need those two things to happen, but if they do, the results from owning Markel at this level should be quite good.

If not, we will be satisfied owning a business that is prudently managed, safe, cheap, and compounding value at a good clip.

Disclosure: John Huber owns Markel for his own account and for accounts he manages for clients.