I wrote a post a few months ago on Fastenal’s quarterly results. As I mentioned then, it’s one of the few companies that puts out an earnings press release that is more like a quarterly investor letter than a typical corporate press release. As I did last quarter, I thought I’d basically share some of the notes I wrote down in my FAST file as I read through the press release. This isn’t comprehensive, but I’ll probably get into the habit of sharing more “stream of consciousness” type comments as I read about companies this year. Hopefully sharing some research scratch notes will be useful for readers…

To recap what I’ve said before, Fastenal is a well-managed business that has done a great job at executing a relative simple business model. They are a distributor of nuts and bolts, among other things, and they are good at it. The company has focused on keeping costs low while making effective investments in its sales force, product lines, and store footprint over the years. The company has produced excellent returns on capital over many decades, which has led to growth and a compounding stock price in excess of 20% per year. I also admire management for their willingness to be transparent and honest about their results.

The business currently is struggling. This is likely obvious at this point, but the energy sector has a long reach and problems are arising at other manufacturing firms and service providers that do business with energy companies. Fastenal is an example of a company impacted indirectly by the commodity rout, as many of its customers do business in the oil and gas industry.

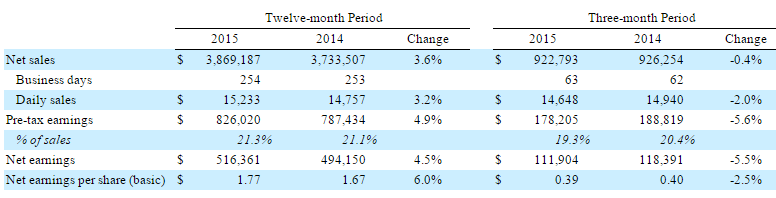

Here is the snapshot of their year:

Here is the month by month growth numbers:

On the surface, it doesn’t look too bad. But Fastenal’s large customers are really struggling. The company breaks its national accounts (which represent about half of Fastenal’s revenue) into two groups: top 100 companies (large firms) and smaller national accounts (companies not in the top 100 in terms of size).

- Net sales to top 100 customers were down -4.3%

- Net sales to all other national account customers were up 8.1%

- Both of these growth rates slowed from Q3 2015 (which were about 1% and 13% respectively)

Growth is slowing, and in the case of the large customers, growth has turned negative. Short of a miraculous rebound in energy prices, there is almost certain to be much more “pain” this year as the companies that Fastenal distributes to are slashing capex budgets, laying off workers, and reducing capacity. Revenue declines at these commodity-dependent businesses (i.e. many of Fastenal’s large customers) are very painful because these are low margin businesses that are forced to make spending cuts in order to prevent cash from drying up.

There isn’t a lot of room for error with these heavy manufacturers. Operating expenses have to be cut and investments have to be delayed. As companies tighten their belts, Fastenal can experience volume declines and price deflation in some of its large accounts (large customers have the negotiating leverage to renegotiate contracts or force Fastenal to cut prices).

This isn’t a terrible problem for FAST, and it’s one that they’ll certainly get through, but it adds an element of cyclicality to its own results.

Fastenal’s stock price has lagged for some time now, and since many investors are worried about Fastenal’s exposure to the energy sector downturn, I thought I’d look to see how the company did during previous manufacturing slowdowns/recessions.

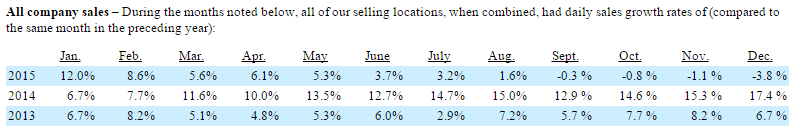

2008-2009 Financial Crisis and Recession

I took a look back at 2008-2009 Fastenal results, and I was quite shocked at how quickly things deteriorated for Fastenal during the recession.

Recall that the financial crisis occurred in the fall of 2008 (most people point to the Lehman bankruptcy on 9/15/08 as the main trigger event that precipitated and accelerated the crisis). The financial crisis seized up the credit markets, causing a deep recession across the broader economy (as many firms that needed access to credit couldn’t get it, causing business to grind to a halt in many industries).

You can see this in Fastenal’s numbers. This is just a snap shot from the 3rd quarter press release on October 12th, 2009:

Company “same store” sales (Sales at stores opened more than 2 years):

Growth went from 10.5% in September 2008 to -3.9% by the end of the year, and by the next month (January 2009) the business was contracting by double digits. Wow… I doubt things get anywhere close to this bad, but it gives you an idea of how quickly this business can be impacted by a shut down in customer spending.

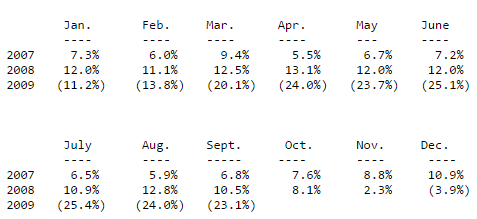

2001-2002 Recession

In addition to 08-09, I also went back and glanced at some old filings from the 2001-02 recession. Fastenal was a much smaller company at this time and was expanding its store footprint at a much faster rate, so growth slowed but did not decline during this particular economic contraction.

I read through the 10-Q from October 2002 and noticed that sales increased 10.6% in the first 9 months of 2002 vs 2001, and earnings were up 1.9%. Growth slowed from previous years, but remained positive.

However, in the 2002 10-Q I noticed that although sales grew, it was largely due to volume increases (thanks in large part to growth in the number of stores).

“The increase came primarily from higher unit sales rather than increases in prices, as the Company experienced some deflationary impact to pricing.”

During this period, as during other periods of economic contraction, sales growth was offset somewhat by price deflation, meaning that they sold more units, but the price per unit decreased.

Lower prices is a sign that customers have some leverage to negotiate pricing with Fastenal during difficult periods. This wasn’t severe in 2002, but it is evident by looking at gross margins, which contracted from 50.6% in 2001 to 49.4% in 2002. Not a big decline, but evidence that Fastenal sees some pricing pressure during tough times. Since gross margins are so high at Fastenal, even a modest 1.2% decline in gross margin meant over $8 million to the bottom line, which is why sales grew by double digits in 2002 but earnings grew just 1.9% (operating expenses were flat at 36% of sales in both years).

Store Growth Is/Was the High ROIC Growth Engine

Speaking of operating expenses, I also noticed a trend in Fastenal’s business relating to its operating leverage. Fastenal has talked in recent quarters about how it is expanding its capacity (i.e. it is preparing for future growth by aggressively hiring new employees and growing its store footprint). This “investing for the future” has paid off for Fastenal, as they’ve consistently achieved double digit returns on capital invested, which has led to growth over time. In 2002 their operating expenses grew by 10.4%, basically exactly the same as sales growth. So the 2002 recession didn’t impact Fastenal significantly. They continued growing sales and investing for future sales growth—employee count increased 16.5% between 12/31/01 and 9/30/02. Net store openings grew 11.1% over the same 9 month period. Other than a temporary decline in the price of their fasteners, Fastenal kept marching through the recession.

But again, the company was smaller in 2002, and was rapidly growing its store footprint. 2014 and 2015 saw a net shrinking in this store footprint, which makes it very difficult to grow sales, especially in the current environment. Even in the 2002 period, same store sales growth was very low single digits.

The growth engine, and the beauty of the Fastenal business model, is the fact that they could replicate their model over and over by opening new stores, which produced very high returns on the capital required to open them, leading to sales growth, earnings growth, and a steadily compounding share price.

Also, in 2002 the company didn’t break out “same store” sales by month, but by looking at the trend in the 2001-2002 daily sales growth numbers, it’s clear that the business was affected by the economic downturn that occurred in the industrial sector in 2001 as sales growth slowed from 20% at the beginning of the year to 1.4% by the end of the year. And if not for the 11.1% growth in new stores, overall sales growth would almost certainly have gone negative by year end.

To Sum It Up

I think Fastenal is a good business. However, it has a cyclical nature to its results because many of its customers operate in the commodity space and have very cyclical businesses.

The historical results were much smoother than they might have appeared because Fastenal was always growing its store footprint by double digit percentages. Now that the store base is not growing (or at least not growing as fast), I think we’ll likely see more frequent declines in sales/earnings during future recessions. In short, the overall growth rate will be much slower going forward over the course of the full business cycle.

Looking at the previous two recessions as a crucible for the next one, I come to the conclusion that Fastenal will likely see sales and earnings declines that while temporary, could be significant. In the last recession, sales declines reached over 20% and stayed there for many months, affecting Fastenal’s bottom line to an even greater degree as negative operating leverage (like financial leverage) works both ways and in this case worked against the company as sales declined 22% in the third quarter of 2009 while earnings declined 35%.

In the 2002 recession, sales growth declined to almost 0%, but stayed positive thanks to double digit growth in new store openings. This tailwind is no longer available to Fastenal.

On the positive side, despite sales and earnings declines, Fastenal did remain profitable during the recession (albeit at a lower level), and subsequently recovered and sales and earnings grew to new heights during the recent recovery of the past few years.

But I think the worst of the commodity downturn has not come close to getting priced into many companies who do business in the energy sector, and I think Fastenal is probably one of them.

I recently wrote a post discussing long-term thinking, and how investors should look out 3-5 years and not make investment decisions based on the next few quarters. In this case, I would still look out 3-5 years, and I believe Fastenal will likely have slightly better earning power then than they do now, but given the current valuation level of over 20 times last year’s earnings (and given earnings have shown a susceptibility for short term declines during recessions), I’ll continue to pass on the stock at this level. I think the price relative to normal earning power—even looking 3-5 years out—continues to not have the margin of safety that I’m looking for.

I’ll continue to keep the company on my watchlist, and I’ll continue to evaluate it if it gets cheaper. For now, I think there are much more interesting opportunities, given the current market conditions. We’ll discuss some of those as well at some point…

John

———

John Huber is the portfolio manager of Saber Capital Management, LLC, an investment firm that manages separate accounts for clients. Saber employs a value investing strategy with a primary goal of patiently compounding capital for the long-term.

I established Saber as a personal investment vehicle that would allow me to manage outside investor capital alongside my own. I also write about investing at the blog Base Hit Investing.

I can be reached at [email protected].