Michael Burry’s story is captivating. And in fact so good of a story that excellent financial storytellers like Michael Lewis and Greg Zuckerman turned it into main portions of best-selling books on the financial crisis.

The story goes something like this: Burry was just a guy writing a blog (before people knew what a blog was). He was discussing his ideas in early internet chat rooms. He picked stocks. He was a value stock picker at a time when value investing couldn’t have been less popular—the late 1990’s. But Burry did well investing his own account, and he got a small following on these early message boards. One day, he posted that he had decided to leave medicine, and he was starting his own fund. Joel Greenblatt—who had been reading, and profiting, from Burry’s posts—promptly contacted Burry, offered him a million bucks for an equity stake in his new business, and help seed Burry’s tiny fund.

Burry gained success as a stock picker who preferred bargains over market darlings, but he became famous when Michael Lewis wrote a book about the famous subprime trade. Burry went from a complete unknown (but very successful) stock picker to a fund manager who brilliantly predicted and profited from the biggest bubble in decades. His trade became the focal point of the financial crisis books, and his name became known by the heaviest of hitters such as Warren Buffett and Alan Greenspan.

Burry’s story is often told as a Cinderella type story about “just a guy” who was a good stock picker, got discovered, and then made it big in a Soros-esque trade of a lifetime.

Not exactly… That is how the sequence of events unfolded, but I think the story of Burry’s success in the subprime trade actually downplays how talented a stock picker the guy really is. He deservedly gets attention for his investment in the credit default swaps that soared when housing crashed. But as he himself states in his investor letters, he’s a stock picker at the core. He is classic value investor, hunting for bargains in the nooks and crannies of the market. As he said of his own philosophy in an early post:

“My strategy isn’t very complex. I try to buy shares of unpopular companies when they look like road kill, and sell them when they’ve been polished up a bit.”

The thing I admire most about Burry is his ability to think independently. He studied Buffett, but realized Buffett couldn’t be cloned. His style was originally much closer to Ben Graham’s—he was a bargain hunter. But he didn’t clone Graham either. From what I can tell, he simply looked for bargain-priced stocks by turning over a lot of rocks. Many of his early investments were sort of special situation type bargains—some with catalysts that played out fairly quickly, others just unloved and neglected bargains selling for less than a private buyer would be willing to pay for the business.

This weekend, I happened across a link to a very nice write-up and summary of Burry’s original posts on the message board I referenced above. It prompted me to re-read the compilation of Burry’s original articles he wrote for MSN Money, as well as review a couple old letters that I printed off. Unfortunately, I don’t know if Burry’s original Scion Capital letters are still in the public domain, but if anyone would be willing to share them with me, I’d love to read them. I only have a few of them. As for the MSN articles, they were written for the lay-person investor, but they provide a glimpse into how Burry thought about his investments.

I thought I’d highlight just a few clips from the investor letters and the MSN letters. The first thing I thought was remarkable was the fact that Burry was very bearish on the stock market in 2001, yet he remained fully invested and produced incredible results from buying bargains: +36% annually for the first 2+ years of his fund, even as stocks were in an extreme bear market, with the S&P dropping 50% and the Nasdaq falling 80% from their 2000 highs.

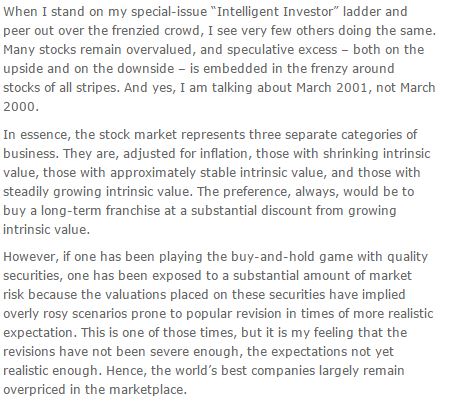

He describes his pessimism on the overall stock market in an early investor letter:

He describes a situation that could easily describe 2015. Established companies with durable products, competitive advantages, and stable long term prospects (but with no real hope of growing much faster than 7 or 8% annually) are priced at 20 to 30 times earnings in many cases (I’m referring to large, high quality stalwarts at these valuations. This isn’t to mention the ridiculous valuations of some of the more recent IPO’s). The popular argument for this seemingly pricy valuation among high quality companies rests on the fact that interest rates are so low—a dubious justification in my view.

But back to 2001… Despite Burry’s lack of enthusiasm for the overall stock market and general valuations, and despite his bearishness on the economy, he remained fully invested in stocks he thought were undervalued. This is a good lesson—his bearish assumptions were correct, but he still preserved capital and made remarkable returns by staying focused on identifying undervalued securities and not worrying about where the market will go next:

“So, I will go on record right now as saying that this is a time of tremendous uncertainty about market direction—but no more so than at any time in the past. I continue to believe the prudent view is no market view. Rather, I will remain content in the certainty that popular predictions are less likely to come to pass than is believed and the absurd individual stock values will come along every once in a while regardless of what the market does.”

Burry turned out to be correct in his assessment that the market was overvalued, even after a significant drop. But what’s interesting to me is that he still maintained a fully invested portfolio filled with bargain securities.

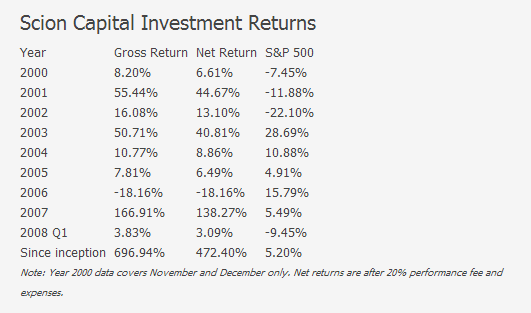

In his early letters he describes how he maintained his portfolio filled with cheap stocks, and despite his bearishness, was long bargain stocks that did extraordinarily well as the overall market dropped 50% from 2000-2002. Here are his early results (Burry started his fund in November 2000):

- 2000: +8.2% (vs -7.5% S&P 500)

- 2001: +55.4% (vs. -11.9% S&P 500)

- 2002: +16.1% (vs. -22.0% S&P 500)

So for the first 2 years and 2 months of his fund, he had compounded at a rate of 36.1% per year vs. a CAGR of -18.8% for the S&P 500.

And it’s remarkable that this was done primarily being long stocks with basically no shorting. Burry said in his 2006 investor letter that:

“A Scion portfolio will be a concentrated portfolio, though, and I have generally thought that in any market environment I should be able to spot the handful of investments that will make all the difference.”

So I think it’s notable that although Burry was extremely bearish (as described in his letters and the MSN articles), but he still stuck to his knitting—looking for low risk bargains.

Buffett and Munger said something similar at the recent meeting about just looking for undervalued companies and let the macroeconomic tide take care of itself.

Burry eventually got much more interested in the macro tides, and profited from it, but I think his early results as a stock picker are a good reminder that regardless of how overvalued we think the market is, there are always opportunities to invest in low risk, high probability bargain situations.

As for the MSN articles, Burry’s value stock picks there also did very well, even as the broad stock market indexes got crushed. His picks returned +23% while the S&P 500 dropped 22% and the Nasdaq plummeted 58%—a testament that in most markets, good old fashioned value can in fact protect capital from permanent capital loss.

One other comment from Burry on why it’s more important to focus on bottom-up stock picking than to try and predict stock market movements:

“Regardless of what the future holds, intelligent investment in common stocks offer a solid route for a reasonable return on investment going forward. When I say this, I do not mean that the S&P 500, the Nasdaq Composite or the market broadly defined will necessarily do well. In fact, I leave the dogma on market direction to others. What I rather expect is that the out-of-favor and sometimes obscure common stock situations in which I choose to invest ought to do well. They will not generally track the market, but I view this as a favorable characteristic.”

Here are Scion’s returns over the life of his fund until he liquidated the partnership:

Here are a few other links of interest regarding Burry and the financial crisis: