Since oil prices were in the headlines yesterday after an 8% fall, I thought it might be a good time to comment on something I’ve been working my way through while putting in the miles after a day of looking for bargains.

I’m about halfway through the excellent series of podcast called “A History of Oil”. It’s an outstanding series that starts by introducing George Henry Bissell—the father of the oil industry—who in 1853 began experimenting with “rock oil” that was discovered in northwestern Pennsylvania. Bissell commissioned a $526 study of this strange substance and determined that it could be refined into kerosene—a highly demanded fuel used to light homes at night. Since whale blubber was becoming more costly (you could say the world was witnessing “peak whale”—i.e. whale population was plummeting), this newfound oil could prove to become quite lucrative as a whale blubber substitute.

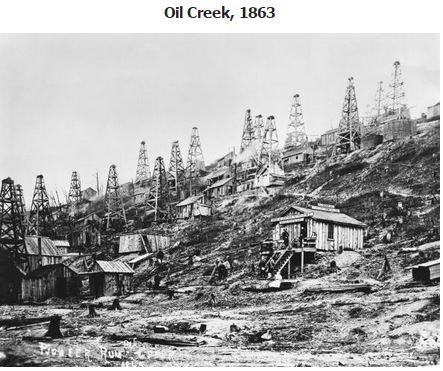

The History of Oil series then moves to the fascinating beginning of the oil industry at “Oil Creek”, the stretch of the Allegheny River where drilling for oil first started in the small town of Titusville. This tiny hillside town in northwestern Pennsylvania quickly became the 1860’s version of the California gold rush. The population went from a sleepy 250 to a bustling 10,000, real estate prices skyrocketed, and fortunes were made. A lucky man named Jonathan Watson became the first millionaire from oil—Watson owned the land where the first successful well was drilled by Colonel Edwin L. Drake—an employee of Bissell’s Pennsylvania Rock Oil Company.

The podcast series recounts the early tales of riches and the many booms and busts. I’ve made my way through the portion of oil history that witnessed a 23-year old grocery store owner named John D. Rockefeller, who began selling kerosene in his store—and eventually transitioned into the refining business that later was built into Standard Oil—one of the world’s most valuable, and most intimidating companies of all time.

Indeed, it was the very first Big Oil—later to be broken up when an ambitious populist from Ohio named John Sherman—whose resume included three terms in the House of Representatives, the US Senate, Secretary of the Treasury, and Secretary of State—introduced a bill called the Sherman Antitrust Act. The bill passed 52-1 in the Senate and unanimously in the House. The law sparked the first of many battles between Big Oil and government regulation.

Standard Oil was broken into pieces, but not before John D. Rockefeller became the richest man in the world—creating a net worth that would approach half a trillion bucks in today’s dollars—far more than Gates, Buffett, or any of today’s titans. Not bad for a guy who, as an ambitious young grocer, set a goal of making $100,000 during his lifetime.

The Oil Business

I began slowly investigating the oil industry last fall as energy prices plummeted. There is one company I have taken small positions in on a couple occasions, but by and large I have stayed on the sidelines as I continue to watch debt-laden businesses continue to struggle and cash flow dry up. Many of these companies are dead companies walking—almost certain to go bankrupt as their revenues fall, margins evaporate, and fixed costs (i.e. interest payments) persistently eat up a larger share of each barrel produced.

I think the oil business is very interesting, and it is one of the industries (especially the “upstream” exploration/production side) that really lends itself to the classic boom/bust cycle.

Soros once said regarding oil prices in his “real time experiment” in 1985:

“The supply curve is inverted. Most producers need to generate a certain amount of dollars; as the price falls, they will try to increase the amount sold until the price falls below the point at which high cost producers can break even. Many of them will be unable to service their debt.”

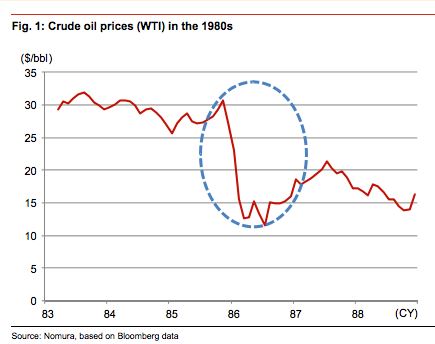

The more things change, the more they stay the same. In 1985 Saudi Arabia became frustrated that their production cuts weren’t having the impact they desired (which was oil price increases). This led them to decide to shift its focus from prices to market share. In December of 1985, OPEC shocked everyone by formally announcing its intention to maintain market share (i.e. maintain or increase production levels). The price of oil collapsed 50% over the next 6 months from $30 to $15 per barrel.

This 1986 price collapse was quite similar to the chain of events that unfolded starting last November 2014 when OPEC again announced its intention to maintain production in an effort to squash US high cost producers and maintain market share.

In both 1985 and 2014, these decisions by producers (both OPEC and US domestic producers) defied the logic of the “rational economic man”.

Where is the “Rational Economic Man”?

The “rational economic man” theory in economics basically says that this hypothetical figure will always act with perfect knowledge and complete rationality in pursuit of his own economic interests—meaning he will act in such a way that the supply/demand balance will always stay close to equilibrium. For example, as the price of a commodity falls, demand should theoretically increase and/or production should decrease—this balance should always trend toward equilibrium.

This makes a lot of sense. For example, chemical companies add capacity and/or increase utilization when prices are rising in order to satiate demand. Like most commodity businesses, this eventually leads to excess capacity and bloated cost structures. As the cycle surpasses its peak, companies are forced to lay off workers, cut back production, and sometimes take capacity out of the system as prices are falling, which then sets the cycle up for another repeat.

So eventually the economic man shows up and the cycle ends. But in the meantime—before this self-correcting process occurs—a self-reinforcing behavior (as Soros calls it) is prevalent—a behavior that takes prices (and supply/demand) far from “equilibrium”—or where they should be based on economic theory.

So sometimes there is a disconnect between reality and economic theory and the “economic man” is nowhere to be found.

For example, banks influence the value of the collateral as they lend more. In the recent case of the mid-2000’s housing bubble, securitization and newfangled financial products such as synthetic CDO’s reinforced home prices—these new products created an entire new market for CDO’s and the demand from investors for these securities fueled more lending. The more loans that were packaged up and sold in the form of securities, the more lenders were willing to give loans, which meant easier credit and more demand for the actual product—the house. This circular cycle was self-reinforcing for a period of years. Banks were willing to lend up to 100% (or more in some cases) on the ever-rising value of a house, but this value was rising in large part because of the fact the bank was willing to lend on it. It’s the chicken and the egg.

This is the same concept that has occurred in virtually every boom/bust cycle in the past.

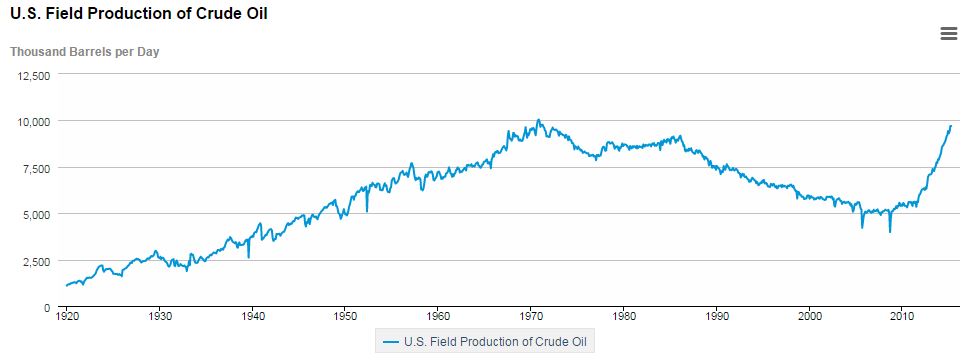

The oil industry behaves in a similar way. Interestingly, what has happened over the past 9 months has surprised many economists and industry analysts. When prices started falling, many predicted drastic cuts in production by the high cost shale producers. Eventually, this would have to be true as producers run out of money. But what is interesting is that they continue to produce more as long as they have the cash in the bank to do so—even if they destroy value with every barrel that they pull out of the ground. By April 2015, six months after the price declines began, US production was at multi-decade highs:

So despite what economic theory says, what has actually happened on numerous occasions is that as energy prices decline, sometimes production increases (or at least remains stable) by producers who desperately try to maintain market share or by countries (such as the OPEC nations) who increase volumes to offset price declines in order to meet budgetary needs.

This was true in the late 1960’s when Soros was formulating his reflexivity theory, it was true in 1986 when Saudi Arabia dropped the hammer on the oil market, and it is true today as OPEC—at least for now—continues to maintain its production level.

Interestingly, this very same behavior was prevalent in the 1880’s at Oil Creek.

Even back then, or maybe especially back then, oil prices swung violently as supply/demand fluctuated and the boom/bust cycles repeated themselves over and over again. This nonsense was much to the dismay of Rockefeller, who specialized in the “downstream” business of refining oil—which means he had to buy his raw material from these irrational producers and was thus at mercy to the wild swings of the market.

One of the episodes of A History of Oil describes the fascinating turn of events as Rockefeller defies the advice of his own board of directors and—in an effort to fight this irrational behavior of the producers who frantically began drilling more and more in a “race to the bottom” as prices plummeted—began buying up “every barrel” of oil that was produced. Rockefeller eventually forced his company into the upstream (production) business in order to try and get more control over the raw material needed for his kerosene, and thus add an element of “economic man” behavior to the industry.

But whether its human nature or the nature of the oil business (or probably both), this defiance of economic logic repeats itself over and over.

Just this past weekend, Iran pledged to double its own production when/if sanctions get lifted—despite oil prices at half of where they were trading at a year ago.

Meanwhile, US oil production has begun to slow down in the past couple months, but as recently as April, crude output was rising and reached a high not seen since 1972—leaving analysts, economists, and Middle East oil producing nations scratching their heads.

It’s very interesting theater.

I’d recommend A History of Oil to anyone who is interested in locating bargains (or short opportunities) among the carnage in oil that is certain to continue if prices stay where they are. The business is a difficult one—like most commodity businesses. But it’s one that probably provides significant opportunity for the skilled bargain hunter who can be greedy when everyone else is fearful.

Caveat Emptor…

Have a great week.