Update: For those interested, I wrote a 5-part series about the concept of return on incremental invested capital and also a few other writings that discuss ROIC.

This is part 2 of my follow up thoughts on compounders, cheap stocks, and the importance of returns on capital. Part 1 is here. Also, some previous posts before that are relevant to this post as well:

- Thoughts on Return on Capital and Greenblatt’s Magic Formula Part 1

- Thoughts on Return on Capital and Greenblatt’s Magic Formula Part 2

- Buffett Shareholder Letter High ROE

- Wells Fargo vs. Small Community Banks

- A Few Thoughts on Buffett and Great Banks

To recap last post, I basically wanted to convey that valuation and quality are not mutually exclusive. There seems to be two factions within the large value investing community. It sometimes feels like a presidential primary race. We’re all on the same team at the end of the day, but these two factions seem to always disagree on numerous points. The factions I’m referring to are the Graham deep value followers and the Buffett quality company followers, for lack of a better way to put it.

I espouse that there really isn’t as much of a difference between the two that everyone seems to think. The end game is that we are all trying to locate low risk 50 cent dollars.

In the last post, I made a comment about Fastenal, and that the stock has been one of the best performers in the US Stock market in the last 25 years, averaging better than 20% annual returns since the late 1980’s. Of course, many will say: “sure, it’s easy to use FAST as an example”. That’s true, it is…

And I agree that even though paying 50 times earnings would have worked very well for FAST shareholders in 1989, I’m not interested in going anywhere near that type of valuation, because I don’t want to rely on my dubious ability to predict the future that far in advance. However, this does not mean that I want to abandon my effort to study some of the most successful businesses of years past. Improving pattern recognition skills increases the probability of successfully identifying these types of quality firms going forward.

I want to find good businesses and I want to own them. I just am not willing to pay the prices they typically trade at. So I wait for opportunities for good operating businesses at cheap prices, occasionally investing in some special situations, hidden asset situations, or other undervalued safe ideas. Often enough, I’ll locate an idea where I can buy into a quality company at a very cheap price. In the last post, I referenced a very low risk, low cost bank that I own that has grown book value at 9.3% annually over the past 15 years without a single down year, has paid a sizable dividend every year since 1926, and yet could be purchased at 7 times earnings and 60% of book value. Those are the types of compounders that I like to own. If I’m wrong about the quality, I didn’t pay much for it. If I’m right about quality, my returns will be significantly better than a similarly valued lower quality stock.

As Pabrai says, “Heads I win, tails I don’t lose much”.

Return on Invested Capital is Most Important Over Time

The following is a collection of some comments that I made following one of the previous posts. I thought it would be interesting to demonstrate the importance of quality (return on capital) when it comes to long term ownership of equities. Again, this doesn’t mean that buying at 70% of book value and selling at 100% is a bad idea (on the contrary, it’s one that I will participate in under certain circumstances) it just means that over time, companies that can consistently produce returns of 15% on their capital are going to create far more wealth for their owners than companies that only produce 5% on their capital.

As I mentioned, I’ve done some rudimentary studies of this ROIC vs Value topic previously. A good way to demonstrate the importance of high returns on capital is to look at long term shareholder returns (over 15-20 years or more). For example, I just picked up my Value Line and flipped to the steel section, and industry that is known for their low returns on capital over time. Note: the steel industry is cyclical, which leads to very volatile results. The companies will produce periods of very high returns followed by periods of very low/negative returns. But over the full cycle, the economics of the steel business inevitably lead to very mediocre returns on capital of 4-6% in most cases.

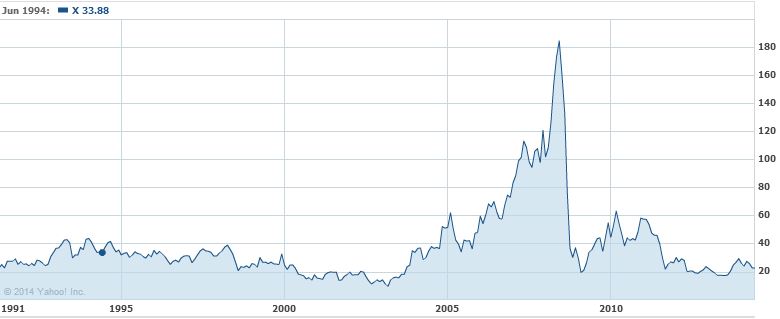

We could do this exercise on a number of stocks, but take US Steel for example. This company has reorganized a couple times in the past few decades and so a glance at the chart doesn’t reflect the entire story, but it still provides a Keynes style “roughly right” look at the results a long term owner would have achieved. Pulling up a long term chart we see that the stock (X) traded around $30 per share in the early 1990’s.

USX earned around $3 per share in the early 1990’s, followed by a few years of losses, and then a period of excellent profits in the early 2000’s, and then back to losses.

But just taking a snapshot in time in the early 1990’s, one could have bought the stock at $30 or so at around 10 times earnings. Today, the stock trades at $25, leaving long term shareholders with a loss of principal after 20 years or so. Interestingly, even if we paid 3 times earnings for X in the early 1990’s—which would have been around $9 per share—our returns over the next couple decades would have only amounted to around 5% per year, which equates roughly to the company’s average return on capital.

Now, you might notice that we could have paid 3 times earnings and then sold out at a profit a few years later, reaping a nice IRR. But this relies on buying low and selling high in a shorter period of time–a feat that is much easier said than done. In retrospect, it seems like a cinch: just buy in 2003 and sell in 2007, right? Some can practice this type of investing, but I find that timing is the most difficult aspect of executing an investment approach, so I try to minimize the importance of getting the timing right.

But the point here is that paying low prices to earnings is more important if your holding period is a shorter period of time and you have confidence in your ability to know when to unload your shares at a higher price at some point in the future—a necessary skill when trying to buy and sell mediocre businesses that produce unexciting returns on capital.

Some Other Examples in Steel

Flipping through the steel section of Value Line, this example holds true with many other steel stocks—subpar ROICs over time leading to subpar investment returns over time. Gilbraltar (ROCK) traded at $7 in 1994 (20 years ago), and it trades at $15 now, an annualized return of just 3.5%.

ROCK paid dividends in some years, but they weren’t large dividends, and even if we add 2-3% to those returns, they are still mediocre.

One more example: Ampco-Pittsburgh Corp (AP) traded at $8 in 1994, and it trades at $21 today, a 4.9% annualized return before dividends, which again might add 2% or so to those returns.

An interesting note with AP, if we go back even further to 1984 (30 years ago), the stock traded at $22 per share. So 30 years later, our poor long term shareholder has roughly the same principal that he started with 3 decades ago, albeit at a much lower real value! It is likely that a buyer of AP stock in the mid 1980’s could have paid far less than 1 times earnings for AP, and still be left with very mediocre long term returns.

I’m not trying to pick on steel stocks. They are just an example of an industry that is burdened by miserable economic headwinds that has left most companies struggling to earn adequate returns over time. Of course, not every steel company produces low returns. The low cost producer might be able to sustainably create above average returns on capital over time. But in a business like steel or any other commodity business, it’s tough.

The exercise is really about any company that produces low ROIC vs any company that produces high ROIC over long periods of time.

High ROIC always wins in the end, given a long enough time horizon.

Compare Long Term Results from High ROIC Companies

One of the best performing stocks of the past quarter century is Fastenal (FAST). FAST sells nuts and bolts, sounds basic enough… but the returns are far from basic. The company averages around 20% returns on capital and produces very consistent results. 25 years ago, the stock traded for a split adjusted $0.32. Today it trades at $44, or 138 times the price in 1989. A $10,000 investment in FAST in 1989 would be worth just shy of $1.4 million today and it would be throwing of $30,000 per year in dividend income to boot—the annual income from the dividend alone is three times the total initial investment! The stock has averaged 21.8% annualized returns not including dividends. This outstanding long term investment result nearly matches the company’s average return on capital over that time.

Fastenal earned roughly $3 million in 1988, and a buyer of FAST paid somewhere around 25 times earnings for FAST in 1989. But a buyer could have paid 50 times earnings for FAST in 1989 (or roughly $0.65 per share) and the compounded annual return would have only decreased from 21.8% to 18.4%…. a big difference over time, but certainly still a splendid result.

This is just one simple example, but a similar long term result could be observed with Walmart, McDonalds, Starbucks, The Gap, Wells Fargo, M&T Bank, Eaton Vance, and many other well-known examples of high ROIC companies that have correspondingly high stock CAGR’s over time.

Valuation and Quality: “Joined at the Hip”

The idea here is not to attempt to push long term compounders. And these comments above will agitate deep value guys. But, I certainly am NOT recommending paying 50x earnings—even for great businesses. Capitalism is too competitive and the future is too uncertain (at least for me) to be able to consistently pick out the next Fastenal.

But it does demonstrate that a business that can sustainably produce high returns on incremental investments over long periods of time (a good business) is far more important for long term shareholders than the price they initially pay for that business.

Again, I cannot emphasize enough that valuation is more important over shorter time periods, quality is more important over long time periods (10-15 years or longer). The longer you hold a stock, the more important the quality of that company is, as your long term returns will approximate the company’s business results–and their internal returns on capital over time.

In the shorter term (1-3 years), valuation is key. You can buy a steel company at 5 times earnings and will likely have the chance to sell it at 10 times earnings at some point. Same goes for low P/B stocks, net-nets, etc…

It seems that the two factions I referenced above always want to put their style into a box. I try to think about it more simply, more logically. If my goal is to locate and own a group of businesses, I want those businesses to be of high quality, conservatively financed, predictably stable, well managed, and cheap.

Forget about the metrics, the style boxes, the value leader you follow, etc… just try to think about what kind of business you want to own, and what kind of long term rate of return you demand, and then search out ideas that match those things. Look for the simple, the understandable, and the obvious—large gaps between price and value.

The objective is the same: figuring out what something is worth and paying a lot less for it.

_____________________________________________________________________________

John Huber is the portfolio manager of Saber Capital Management, dressme.co.nz/ball-dresses.html”>LLC, an investment firm that manages separate accounts for clients. Saber employs a value investing strategy with a primary goal of patiently compounding capital for the long-term.

John also writes about investing at the blog Base Hit Investing, and can be reached at [email protected].