Earlier this year I watched Lang Lang play Grieg’s Piano Concerto in A Minor—one of my all-time favorite pieces of music. The concerto is a monster—full of big octaves, virtuosity, excitement and power. It has around 30,000 notes, but the music is tied together with a simple 10 note melody that is repeated throughout the piece.

I am currently working on a few different investment ideas that have numerous moving parts, but as I conduct my research, I continue coming back to just a few key variables that will largely determine the outcome of the business operations and the investment situation. I think that when analyzing a business or a special situation, this is one of the most important things to remember: there are many complicated aspects to analyzing a business—hundreds of data points, thousands of potential outcomes, pages and pages of SEC filings—all which often create a fuzzy view of the future. Sometimes there is no view of the future at all (or at least one that I can’t see), in which case I simply move on to the next idea. But sometimes through the complication and the inevitable unknowns that come with investing, one or two key variables emerge as the only things that really matter in the end.

I came across this quote last week in one of the posts over at Value Investing World, so thanks to Joe Koster for the link.

This is an interesting quote from Buffett from his 2004 shareholder letter, describing how important it is to know the one or two variables that really matter to an investment. There are a lot of things going on with a business, but if you can pinpoint the one or two variables that really matter, you’ll vastly simplify the investment process, you’ll focus your mind on researching and understanding those variables, and you’ll also improve the probability of a successful outcome.

Here is Buffett discussing the importance of simple propositions (emphasis mine):

“Last year MidAmerican wrote off a major investment in a zinc recovery project that was initiated in 1998 and became operational in 2002. Large quantities of zinc are present in the brine produced by our California geothermal operations, and we believed we could profitably extract the metal. For many months, it appeared that commercially-viable recoveries were imminent. But in mining, just as in oil exploration, prospects have a way of “teasing” their developers, and every time one problem was solved, another popped up. In September, we threw in the towel.

“Our failure here illustrates the importance of a guideline – stay with simple propositions – that we usually apply in investments as well as operations. If only one variable is key to a decision, and the variable has a 90% chance of going your way, the chance for a successful outcome is obviously 90%. But if ten independent variables need to break favorably for a successful result, and each has a 90% probability of success, the likelihood of having a winner is only 35%. In our zinc venture, we solved most of the problems. But one proved intractable, and that was one too many. Since a chain is no stronger than its weakest link, it makes sense to look for – if you’ll excuse an oxymoron – mono-linked chains.”

Hopefully Joe doesn’t mind me borrowing the other (very relevant) quote he chose to highlight from Buffett’s 2008 letter. For those who are familiar, Buffett bought an oil stock at the height of the commodity boom just prior to the financial crisis and subsequent crash in oil prices. He liked a lot of things about this company (Conoco), but when it was all said and done, just one variable determined the outcome of this investment: oil prices.

Here is Buffett from the 2008 letter:

“I told you in an earlier part of this report that last year I made a major mistake of commission (and maybe more; this one sticks out). Without urging from Charlie or anyone else, I bought a large amount of ConocoPhillips stock when oil and gas prices were near their peak. I in no way anticipated the dramatic fall in energy prices that occurred in the last half of the year. I still believe the odds are good that oil sells far higher in the future than the current $40-$50 price. But so far I have been dead wrong. Even if prices should rise, moreover, the terrible timing of my purchase has cost Berkshire several billion dollars.”

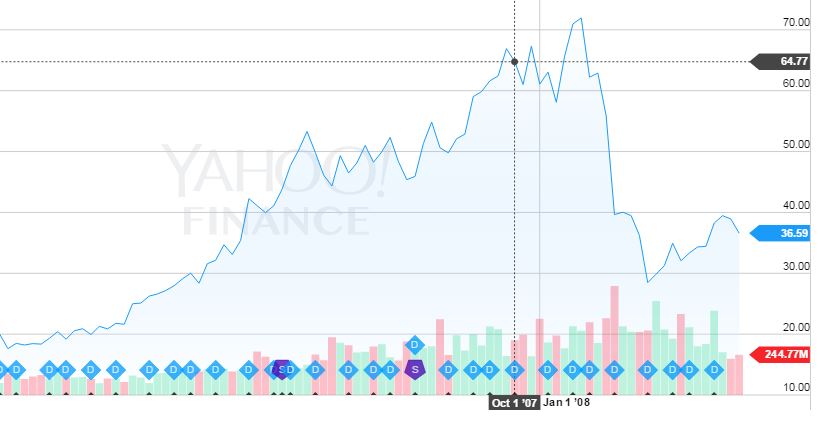

Here is a look at the chart of Conoco—a solid company in the energy sector, but not immune to the downturn in the price of the one key variable that really made all the difference:

While reading through the transcripts of some of Greenblatt’s classes at Columbia, I noticed he mentioned a similar point about being average at valuation work (not really better than anyone else in the business), but being above average at putting the information in context, remembering the big picture, and being able to pinpoint what factors really matter to an investment.

“Explain the big picture. Your predecessors (MBAs) failed over a long period of time. It has nothing to do about their ability to do a spreadsheet. It has more to do with the big picture. I focus on the big picture. Think of the logic, not just the formula.”

So the footnotes are crucial, and occasionally you’ll be able to sleuth out some detail that might give you a big advantage, but I think more often than not, the big picture (in other words, the key variables that matter) is more important than the footnotes. Markel’s advantage is the prudent underwriting, a value investing mindset, combined with a management team that thinks like owners. It’s really that simple—sometimes too simple. Wells Fargo takes deposits in cheaper than just about everyone else. Some of the special situation investments I look at have just one thing that will determine the outcome of the investment—a pending lawsuit, a regulatory resolution, a new order, a sale of an asset, etc… This is a topic for another post, but sometimes I think the best investment theses are also the simplest.

Just like the Grieg concerto—a complex piece of music that is centered on 10 simple notes that make all the difference.