“Investment is most intelligent when it is most businesslike”. – Ben Graham, The Intelligent Investor

This is the time of year that I always look forward to for a variety of reasons. Spring is near in my area of the United States, college basketball tournaments will be captivating audiences around the country, the azaleas will soon be in full bloom at Augusta National Golf Club (the site of my favorite golf major), and my personal favorite: the slew of annual reports and shareholder letters that begin making their way across my desk and into my email box.

Annual Report Time

I receive a lot of reports, but there are a few that I really look forward to reading each year. Last week, I mentioned the Eddie Lampert letter, which is always interesting. Here are a few others that would be #1 or #2 seeds if I were to assemble my own “bracket” of quality shareholder letters:

It’s hard to single out just a few, but the above “Big 4” are certainly four of my favorites. I love the business model that Berkshire, Markel, and Fairfax use–as float can be an incredibly significant source of value creation when used by quality managers with sound business and investing principles. It’s hard not to get excited about quality underwriting that creates permanent low/no cost capital to be invested by quality investment managers. And aside from those three firms, M&T is a bank with a history of top-tier returns on equity–and one of the highest quality banks around. There are many others I anticipate as well: some quite small (here is an excellent series of letters from a tiny, high quality bank), and some quite large (Jamie Dimon’s letters to JP Morgan shareholders are always great).

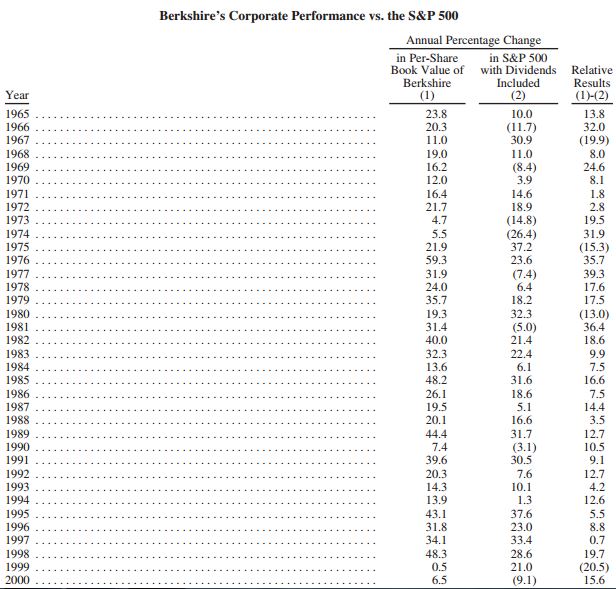

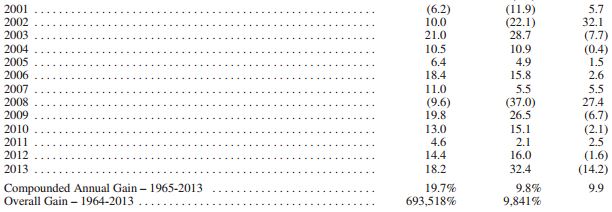

But the Markel, Fairfax, M&T, and Berkshire letters are always at the top of my list. As an aside, those four firms have managed to compound shareholder value at extremely high rates (15-20% annually) over multi-decade periods, so it’s worth reading about how management thinks.

Of course, Buffett’s letter is most famous, and for good reason–despite the ubiquity of Warren Buffett, he still continues to impart incredibly valuable wisdom every time he speaks/writes to the business and investing community.

There are lots of posts summarizing Buffett’s letter. I won’t bother to add my two cents–as I think the letter itself should be read in full. But I did want to comment on one aspect of the letter I found interesting…

How Buffett Thinks About Stocks

Shortly before the letter was released, Fortune released a “sneak peak” of the letter that contained the section where Buffett describes two personal real estate investments. I often get emailed questions from novice investors who have a desire to learn more about investing and want to understand the conceptual aspects of value investing better. I though that this part of the letter did an excellent job at exemplifying the importance of the some of the key fundamentals of stock investing. Interestingly, Buffett did this by discussing two real estate investments that he did with personal (non-Berkshire) money.

I really recommend reading the full letter, but for beginners interested in developing your own investment philosophy, read the Fortune piece, as it will help you understand the importance of having a long term time horizon as well as the importance of viewing stocks as businesses, and not pieces of paper to be traded back and forth. I actually sent this letter in a note to my own investors, as I think it’s an excellent summary of how I think about the stock market. If you manage your own capital, this is how you should think, and if you hire outside advisers to manage your investments, this is how they should think.

Some (Buffett) Thoughts on Investing

Here are a few snippets of this part of the letter:

The Farm

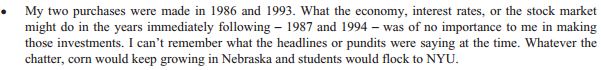

- Buffett purchased a Nebraska farm in 1986 for $280,000

- The earnings from the farm provided him with a 10% annual cash flow return

- Buffett estimates the farm is now worth 5 times what he paid for it (5.9% CAGR)

- Earnings have tripled

- So the estimated 6% annualized appreciation, plus a solid (and growing) annual earnings yield adds up to a superb 28 year investment

The Manhattan Building

- Buffett (with a few partners) bought a foreclosed retail building in New York near NYU from the Resolution Trust Corp in 1993

- The property improved occupancy rates as the market recovered and earnings increased, allowing Buffett and his partners to refinance the building, drawing out roughly 150% of what they invested (so they got their initial investment back–and then some–and kept the cash flowing asset)

- The property now provides annual earnings dividends equaling about 35% of the initial equity investment

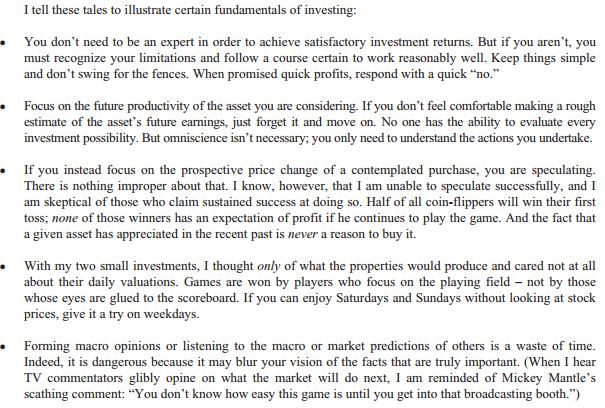

From these two relatively simple real estate investments, Buffett made the following points:

No advanced spreadsheets, no macro forecasting, no earnings models, just some sound principles, common sense, and conservative analysis. Buffett mentions his philosophy–which is probably oversimplified because of the point he’s trying to drive home, but still worth remembering:

No advanced spreadsheets, no macro forecasting, no earnings models, just some sound principles, common sense, and conservative analysis. Buffett mentions his philosophy–which is probably oversimplified because of the point he’s trying to drive home, but still worth remembering:

“When Charlie Munger and I buy stocks — which we think of as small portions of businesses — our analysis is very similar to that which we use in buying entire businesses. We first have to decide whether we can sensibly estimate an earnings range for five years out or more. If the answer is yes, we will buy the stock (or business) if it sells at a reasonable price in relation to the bottom boundary of our estimate. If, however, we lack the ability to estimate future earnings — which is usually the case — we simply move on to other prospects. In the 54 years we have worked together, we have never forgone an attractive purchase because of the macro or political environment, or the views of other people. In fact, these subjects never come up when we make decisions.”

Buffett ends this portion of the letter by paying tribute to Graham, and mentioning an interesting example that Graham used in the 1949 edition of the Intelligent Investor. That year, Northern Pacific, a railroad stock, earned $10 per share and traded at $17 (a P/E of 1.7). This company had a market cap of $40 million, and is now part of BNSF (a Berkshire owned railroad, which earns $40 million every 4 days, according to Buffett).

I thought this part of Buffett’s letter was excellent, and I hope you enjoy it and take the time to read it. I’ll leave you with a chart that I never get sick of looking at… Have a great week: