Below is partial content from a note sent to Saber Capital investors on March 23rd, 2020. To join Saber’s distribution list, please use the signup form on this page.

Bear Market Notes

The COVID-19 panic continues to wreak havoc on both the stock market and the economy, and the news continues to seemingly worsen with each passing day. In the midst of a crisis, it’s imperative to maintain clarity of thought and a calm demeanor. This is difficult for every investor, especially in the context of this particular crisis, which started as a health crisis before morphing into an economic crisis. It is not a fun time, and financial opportunities seem far less important in this particular downturn than in past downturns, simply because of the human toll that this crisis is taking, both in terms of those infected and also those who are about to endure economic hardship.

We will eventually defeat this virus, and as an optimist, my hope is that we will learn from this crisis and be more prepared for the next pandemic. Bill Gates recently warned us that we are not prepared for an epidemic in this country, and he unfortunately was proven right in short order. This needs to change, but the human race is resilient and has an incredible history of solving difficult problems. So, when (not if) we get past this challenge, I’m confident that we’ll pick up the pieces and work to prepare ourselves for the next inevitable health crisis.

From an investing standpoint, I’ve spent time over the weekend looking at previous panics and the ensuing economic downturns. I reread the chapter on the 1973-74 downturn in Roger Lowenstein’s biography of Buffett, The Making of An American Capitalist. That downturn lasted over two years, and broke the will of countless numbers of investors, as the bear market was severe in both depth and duration. The two-headed monster of high unemployment and relentless inflation was brutal, for both investors and consumers alike. Economists predicted that the pie would stop growing and would therefore mean each American’s slice would be smaller. OPEC stopped selling us oil, which led to an energy crisis and long lines at the gas pump. Many thought that the capitalist system had changed, and that America’s best days were behind her. It was a dismal time.

Each panic and recession are unique. But there are also a few common denominators that seem to exist in each one:

- Every time markets plummet, people bring up the 1930’s and worry that stock prices could fall 80%

- Every bear market and every recession have unique aspects to them that make people think the current situation is going to be much worse than anything before

- People sell during these panics because they think prices are going lower

- Experts advise to “wait for more clarity”

Here are some notes I wrote down while reading “The Return of the Native” chapter of the bio referenced above:

Stocks are Future Streams of Cash Flow

Buffett began buying stocks into the downturn early on in 1973. He actually raised debt at Berkshire to give him more fire power. A number of his stock purchases fell 50%, including his initial purchases of The Washington Post, as the market continued to crater. Berkshire Hathaway itself fell by more than half.

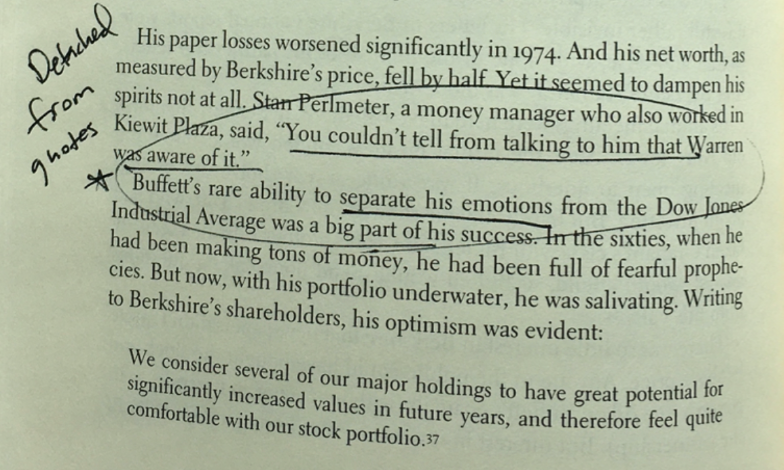

One interesting side note… Buffett was never rattled about stock prices:

Buffett was simply buying stocks of businesses that he felt would be earning good money five years down the road. And when the market offered him cheaper prices, he was happy to take advantage.

He just had no concern over where stock prices would go in the near term. So the lesson is to think of stocks as cash flow streams from businesses, and those cash flows come in over time. Value the stock based on its future cash flow (next 5-10 years), not what it will earn this coming year.

This is especially good advice for the current time, as earnings for nearly every business will look dreadful in 2020 and possibly 2021, but the intrinsic value of a business is much more heavily weighted on the free cash flow that it will earn in later years, not this year. Of course, companies have to survive that long, which means stress testing each position is critical, but there are a number of great businesses out there that will survive this and eventually will reach new earnings highs. These are the companies to focus on currently.

Every Crisis Seems Unique

The other main takeaway is that every time the market plummets, there seems to be a unique situation. As mentioned, in 1973-74 it was an unprecedented spike in inflation combined with a brutal high unemployment rate. This so-called stagflation led people to become miserable. In 1987 people thought the financial markets would crash the economy into a depression, in 2008 it was a housing collapse and people thought the banking system would cause a depression.

Currently, everyone is talking about how bad the economy is going to get, especially in the near term. No one has ever seen the American economy shut down for a few months. It really is unprecedented, and it causes us to fear the worst and believe things will continue to get worse than they are now. Sometimes that’s the case, but stock prices are hard to predict in the short term.

Panic Selling

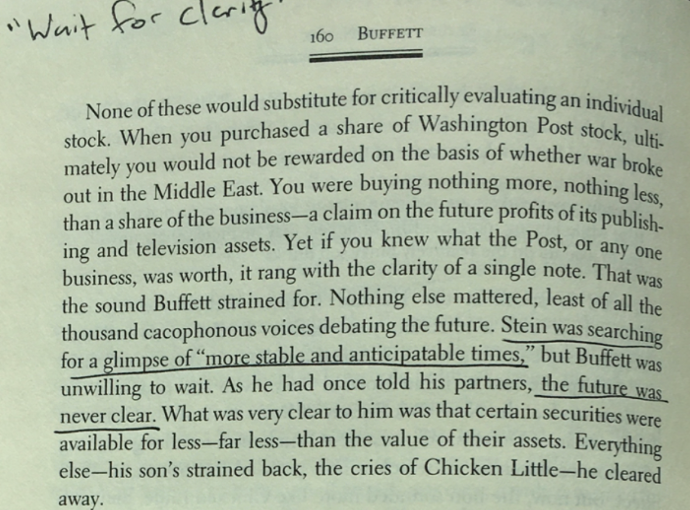

This is well-known, but investors often panic sell stocks at the wrong time. People sell for the simple reason that they fear the share price is going lower. They’re afraid other people might sell. They rationalize the decision by saying “this time is different” and it will get much worse, or that they want to “wait for more clarity”, but the reality is they sell because they think stocks will go lower.

This is really the simple idea of time arbitrage. Lowenstein highlighted one professional investor in 1974 who said now isn’t the time to buy stocks or to be aggressive “unless you could put me on an island and we were taking a three-year view.”This is why the concept of “time arbitrage” is successful over time.

Few investors are willing to take the long view because they’re forced – because of career risk or because of their own behavior – to worry about the next 6 months.

Our Implicit Bet

Currently, it appears to me that our economy is going to suffer, perhaps in a big way. I’m not good at predicting how bad the economy will get or how quickly it will recover, and timing the stock market is even more difficult as stock prices often bottom well before the economy does, but I do believe that certain stocks of great businesses that are undervalued relative to their future earning power, and for those with a long-term time horizon, it’s a good time to be investing in such opportunities.

Investing in stocks is an implicit bet on the future of America. It’s a bet that we don’t just make as investors. Small business owners are making that bet. Workers with hopes of higher wages are making that bet, as are middle-management employees hoping to climb the corporate ladder. It’s a bet that has always paid off in total, and it’s one that I believe will continue to in the future.

From a financial perspective, now is the time to buy stocks for the long run. From a human perspective, it’s a great time to spend time with loved ones, and be thankful for the many priceless assets that we have in our lives. And perhaps enjoy the short commute down the hall to your home office! (I know I am). I truly appreciate your partnership. Stay safe out there!

John Huber is the founder of Saber Capital Management, LLC. Saber is the general partner and manager of an investment fund modeled after the original Buffett partnerships. Saber’s strategy is to make very carefully selected investments in undervalued stocks of great businesses.

John can be reached at john@sabercapitalmgt.com.