I received this interesting comment from a reader and thought I might write a post or two on this topic:

“…There is one very important writer/thinker you do not mention in your site but whom you might want to pay attention to–the Nobel prize winner Daniel Kahneman. After reading him, you will recognize and appreciate the role of luck, the unpredictability of stocks/markets, and that very few people, if any, can beat the market over the long term.

Sure you can point to Schloss, but if his methods were so easy to emulate, there would be tons of managers following suit and racking up his 20% returns year in and year out over long time periods. But this clearly isn’t the case. Instead, as Kahneman argues, we are overly optimistic and operate under an illusion of stock-picking skill that we can PERSISTENTLY outperform the market when the odds of doing so are extremely slim.”

That’s a great comment and it often provokes some fun discussions in the investing community. I’ll provide my take…

There is One Huge Reason Why It’s Difficult To Replicate Great Results

I think that Schloss/Graham type returns are very possible and replicable for most investors, but rarely do those investors achieve them. Here’s the biggest reason why: It’s very difficult to stay the course when your strategy isn’t working.

As Greenblatt says “Value investing works because sometimes it doesn’t work.”

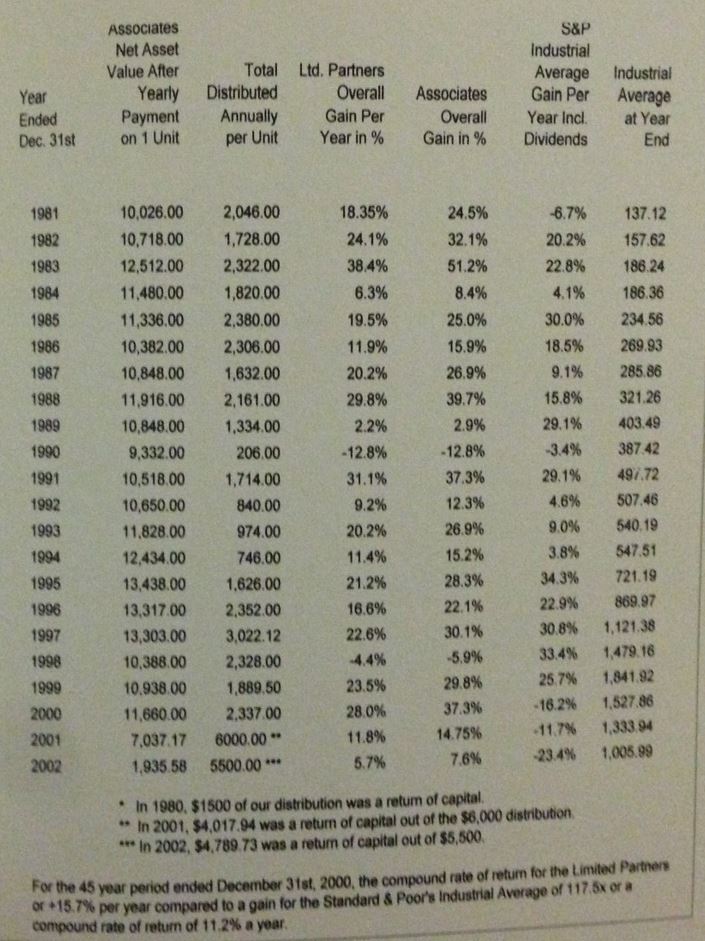

I’ve picked apart Schloss’ returns. Here’s an interesting fact I learned from doing that: despite Schloss trouncing the market by 10% per year (20% vs 10% S&P from 1955-2002), he had numerous 2-3+ year periods of underperformance. In fact, there was one period where Schloss actually underperformed for 10 years!

From 1989 to 1998, the S&P roughly doubled Schloss’ results. This means start to finish… there were years in that period he beat the S&P, but an investor who came in at the beginning of that period would still be behind an index fund 10 years later.

How many mutual funds could survive during that length of time? Any investment manager would lose all of their clients after that length of time. Schloss had a small core group of clients in a partnership, and so he was able to continue working the way he always worked without huge withdrawal problems, but probably somewhere around 99% of the time under similar situations, most investors would leave.

Schloss’ Revenge on the S&P 500

Think about that! Talk about patience… Most investors abandon a strategy if it doesn’t outperform for 3-6 months. Some might give it a year or two. I don’t know anyone that would stick around for a decade. Now, here is an even more interesting anecdote: After that 10 year period, Schloss went on a 4 year run where he trounced the market and made up for the entire 10 year underperformance so much so that the overall 14 year record looked outstanding–in fact, it doubled the S&P’s return over the entire period, despite a decade of underperformance. So the S&P’s margin over Schloss was completely reversed 4 years later! So sometimes value investing is underwhelming.

Greenblatt talked about this as well with his magic formula. Despite making 33% returns in his backtest from 1988-2004, there were two separate 3 year periods where the system underperformed the market. Most investors would bail after that length of time.

Results Can’t Be Replicated Unless the Concepts Are Completely Internalized

So the strategy, and more importantly, the concepts really have to be seared into your psyche to take advantage of the inherent structural edge that the philosophy has. So it’s not as simple as saying “why couldn’t everyone just copy what Schloss did?” Most in fact could with the proper emotional makeup-but don’t (or can’t) because they don’t have that mindset or discipline. It really comes from the fact that most don’t take the time to really understand the concept. They grasp the concept of value investing at a cursory level, but it’s not embedded into their mind, so they bail at the first extended length of poor performance.

As you say (paraphrasing), “if it was easy everyone would do it”. That’s true. It’s not easy… but not because it’s hard to figure out. It’s not easy because it’s emotionally difficult to stay disciplined when everyone around you is making much more money investing in much different (riskier) investments.

So that’s my main thought on why value investing works over the long term. It works because sometimes (often times) it doesn’t.

In a day or two, I’ll discuss the topic of “luck” in investing in more detail in Part 2 of this post.

Thanks for reading and thanks for the comment!